ASSESSMENTS

Concerns About Iran's Falling Nuclear Breakout Time Are Set to Grow

Feb 21, 2020 | 09:00 GMT

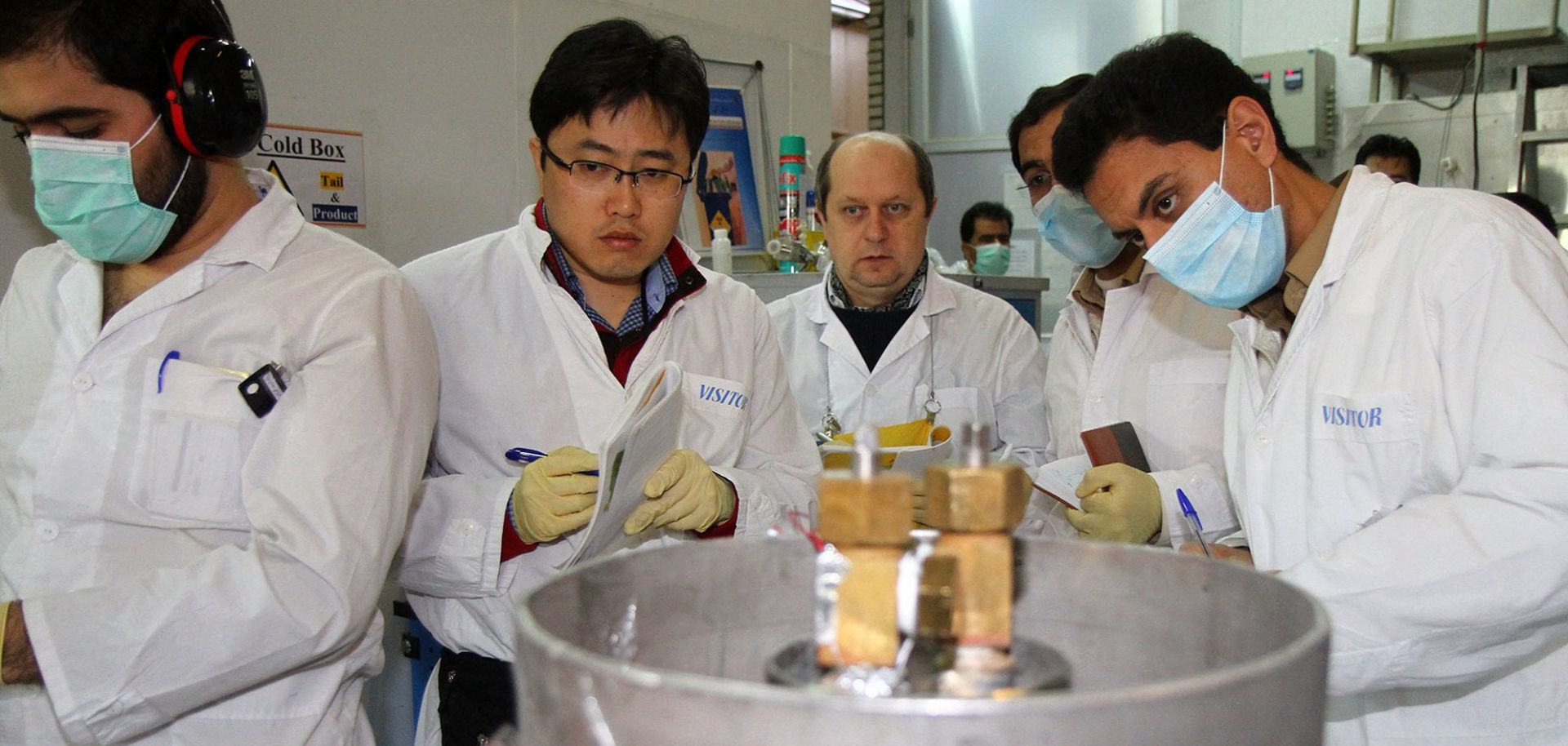

Two inspectors with the International Atomic Energy Agency, second and third from left, observe Iranian technicians stop the production of 20 percent enriched uranium at the Natanz nuclear facility on Jan. 20, 2014.

(KAZEM GHANE/AFP via Getty Images)

Highlights

- While Iran has avoided making any immediately alarming moves with its nuclear program, its accumulation of low-enriched uranium is proceeding at a rate that will sharply reduce its breakout time for a bomb, approaching enrichment levels by this summer that the United States and Israel could find unacceptable.

- Iran's progress on advanced centrifuges is the key signpost to watch next week when the International Atomic Energy Agency issues its latest report on Iran's nuclear activities because the potential for a rapid expansion of processing capacity could sharply and suddenly reduce Iran's breakout time.

- This trajectory is building toward a contentious debate about where the red lines should be for the White House and Israel as the United States heads toward November's presidential election.

Proceed to sign up

Register NowAlready have an account?

Sign In