QUARTERLY FORECASTS

2018 Third-Quarter Forecast

Jun 10, 2018 | 23:18 GMT

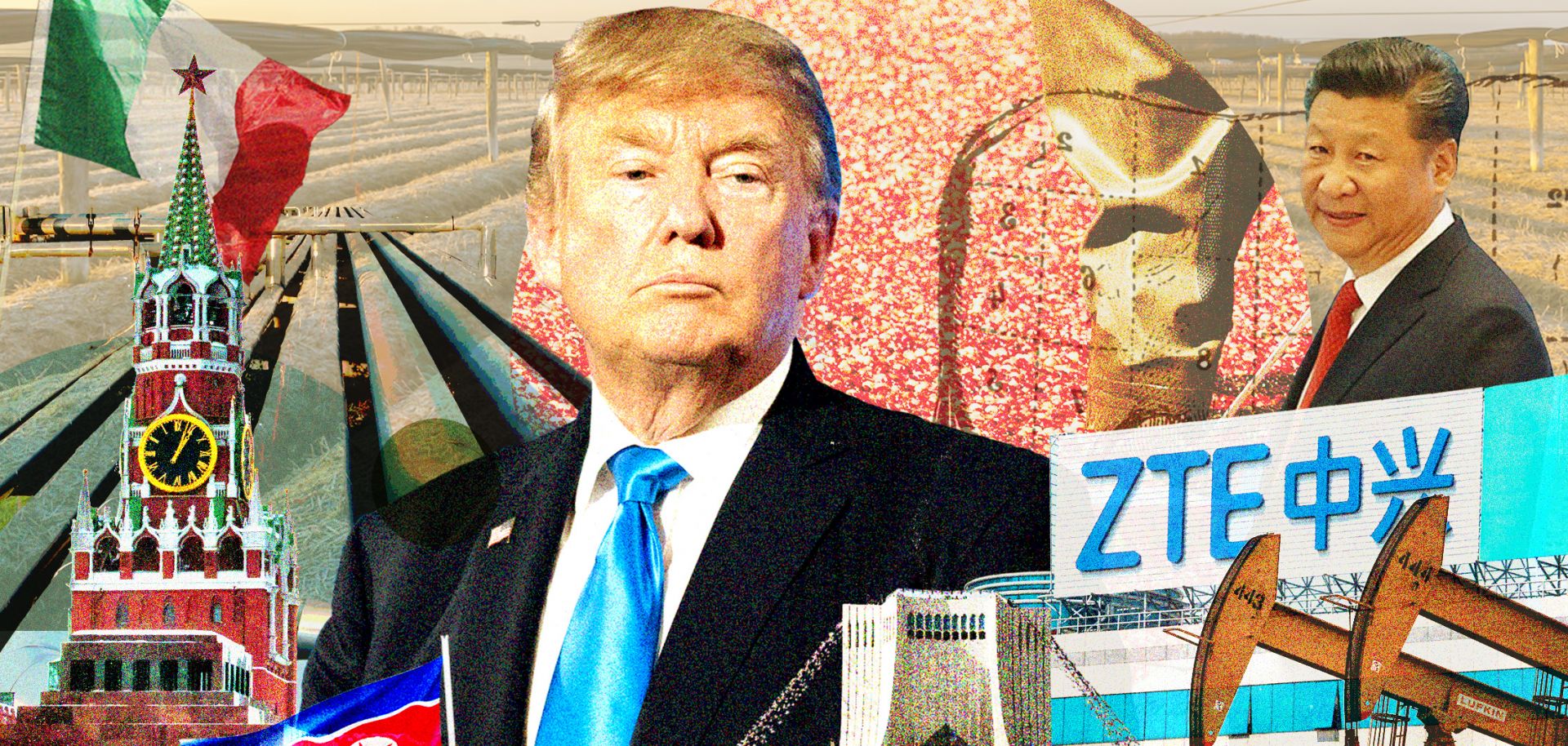

It promises to be an especially fractious quarter as the United States continues to spar not only with adversaries but allies as well. The simmering trade dispute with China will continue, Russia will struggle to break its stalemate with the West, Europe has a litany of problems to address, and anything could happen on the Korean Peninsula.

(ALY SONG-POL/JOHANNES EISELE/HULTON ARCHIVE/MLADEN ANTONOV/TIMOTHY A. CLARY/ABID KATIB/KATJA BUCHHOLZ/DAVID MCNEW/ATTA KENARE/F

Overview

It promises to be an especially fractious quarter as the United States continues to spar not only with adversaries but allies as well. The simmering trade dispute with China will continue, Russia will struggle to break its stalemate with the West, Europe has a litany of problems to address, and anything could happen on the Korean Peninsula. ...

Subscribe Now

SubscribeAlready have an account?