QUARTERLY FORECASTS

2019 Fourth-Quarter Forecast

Sep 22, 2019 | 22:59 GMT

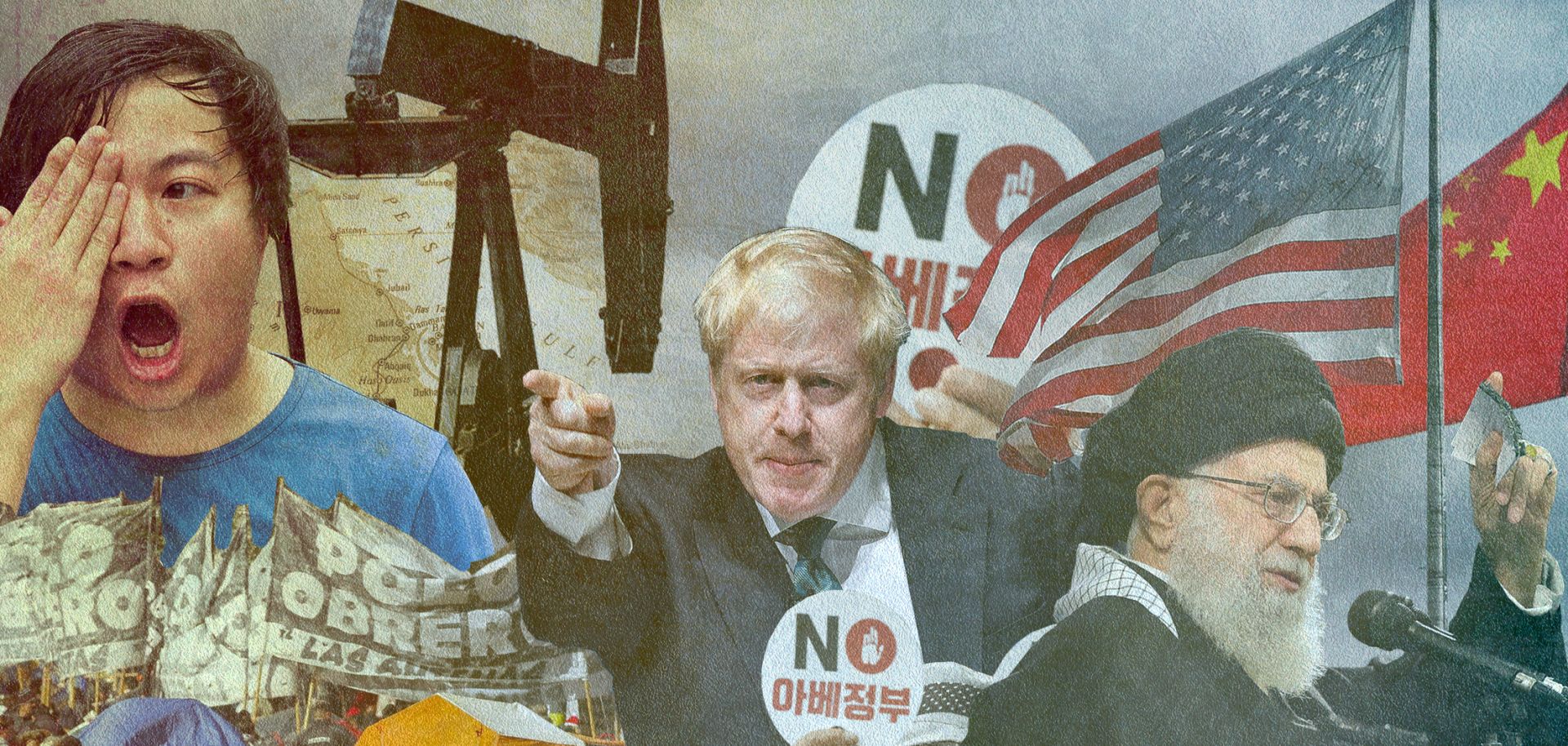

(J. Mitchell/ E. Lasalvia/ J. Yeon-je/ L. Suwanrumpha/ M. Ralston/ I. Lawrence/ Anadolu Agency/ AFP/ Getty Images/Shutterstock)

Overview

The quarter will be defined by the threat of a conflict with Iran that disrupts oil supplies while the global economy nervously anticipates the next turn in the U.S.-China trade war and the possibility of an ugly U.K.-EU divorce. ...

Subscribe Now

SubscribeAlready have an account?