ASSESSMENTS

Argentina: Obstacles to Shale Gas Production

Mar 27, 2012 | 12:25 GMT

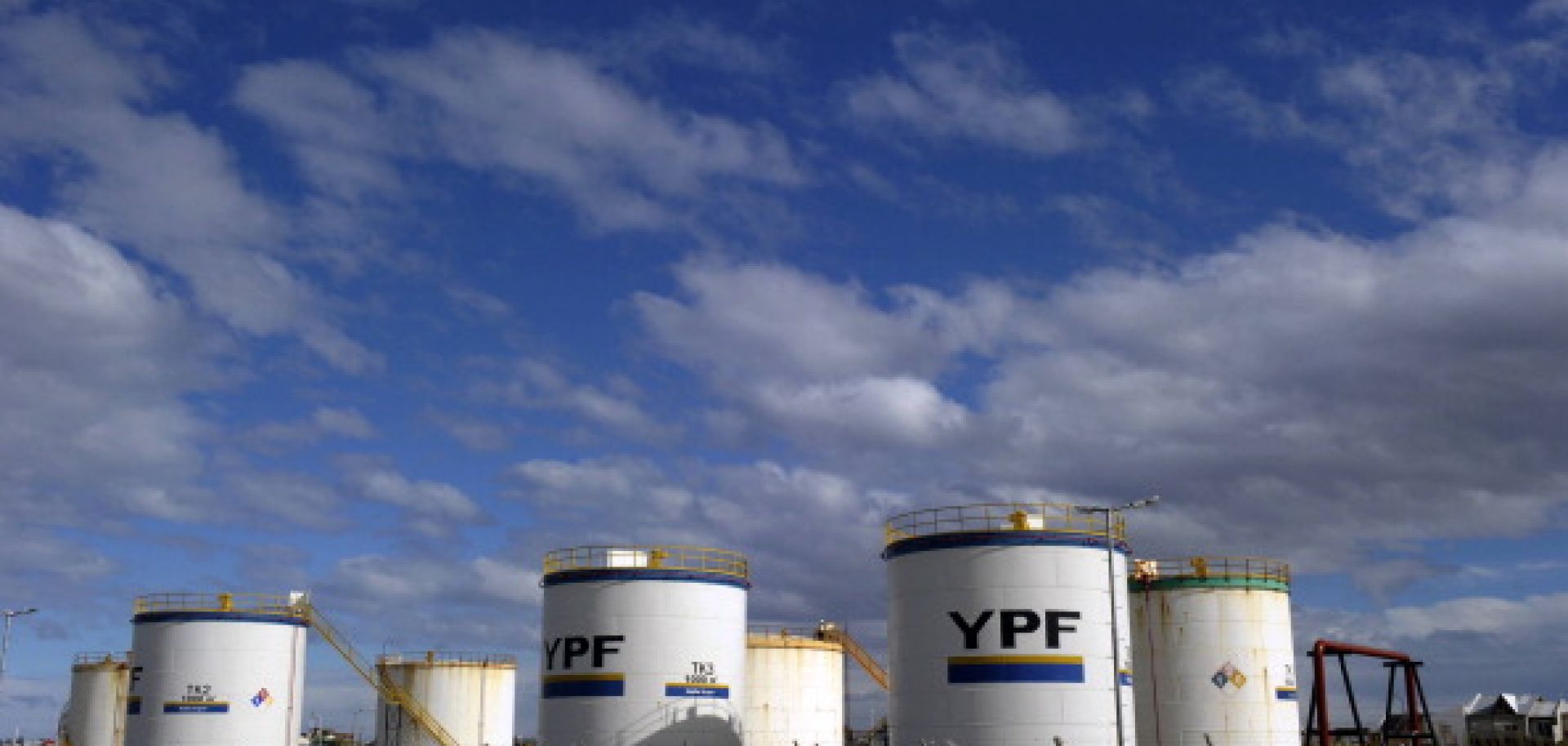

JUAN MABROMATA/AFP/Getty Images

Summary

Argentina relies heavily on fossil fuels for its energy needs. They account for roughly 89 percent of the country's overall energy consumption, and more than 40 percent of that consumption can be attributed to natural gas. Argentine natural gas production peaked in 2006 at roughly 46 billion cubic meters (bcm), but since then production has not kept pace with demand. In fact, production has declined by 10 percent since 2006 while overall demand has increased by 4 percent. This trend culminated in 2008, when Argentina became a net importer of natural gas after having been a net exporter since 1999. As of 2010, natural gas consumption outweighed production by approximately 3 bcm per year.

But the future of natural gas in Argentina may be more encouraging than recent production suggests, especially if Buenos Aires can harness the country's shale gas reserves. Estimates indicate that Argentina has the third-highest recoverable shale gas reserves in the world — roughly 22 trillion cubic meters (tcm). In addition to these potential reserves, Argentina meets several other criteria that would enable it to quickly develop its resources and become a significant shale gas producer.

The problem is that the Argentine energy market operates under tight government control. This control is seen most visibly with government policies that have reduced the ability and will of energy companies to invest in new production. These policies have also placed a heavy financial burden on Buenos Aires, which in the past week revoked oil concessions for Repsol YPF, the country's largest energy company, accordingly. The volatility of Argentina's regulatory environment makes the country a risky opportunity for foreign companies that could provide much-needed capital and technological investments. Given the promising geology and infrastructure associated with Argentina's shale gas basins, this regulatory environment is perhaps the only impediment for quickly producing shale gas on a large scale. If the current negotiations with YPF can be brought to a mutually acceptable end, Argentina could once again achieve energy self-sufficiency and become a net exporter of natural gas.

Subscribe Now

SubscribeAlready have an account?