ASSESSMENTS

Asia's Aviation Sector Reaches New Heights

Sep 22, 2016 | 09:15 GMT

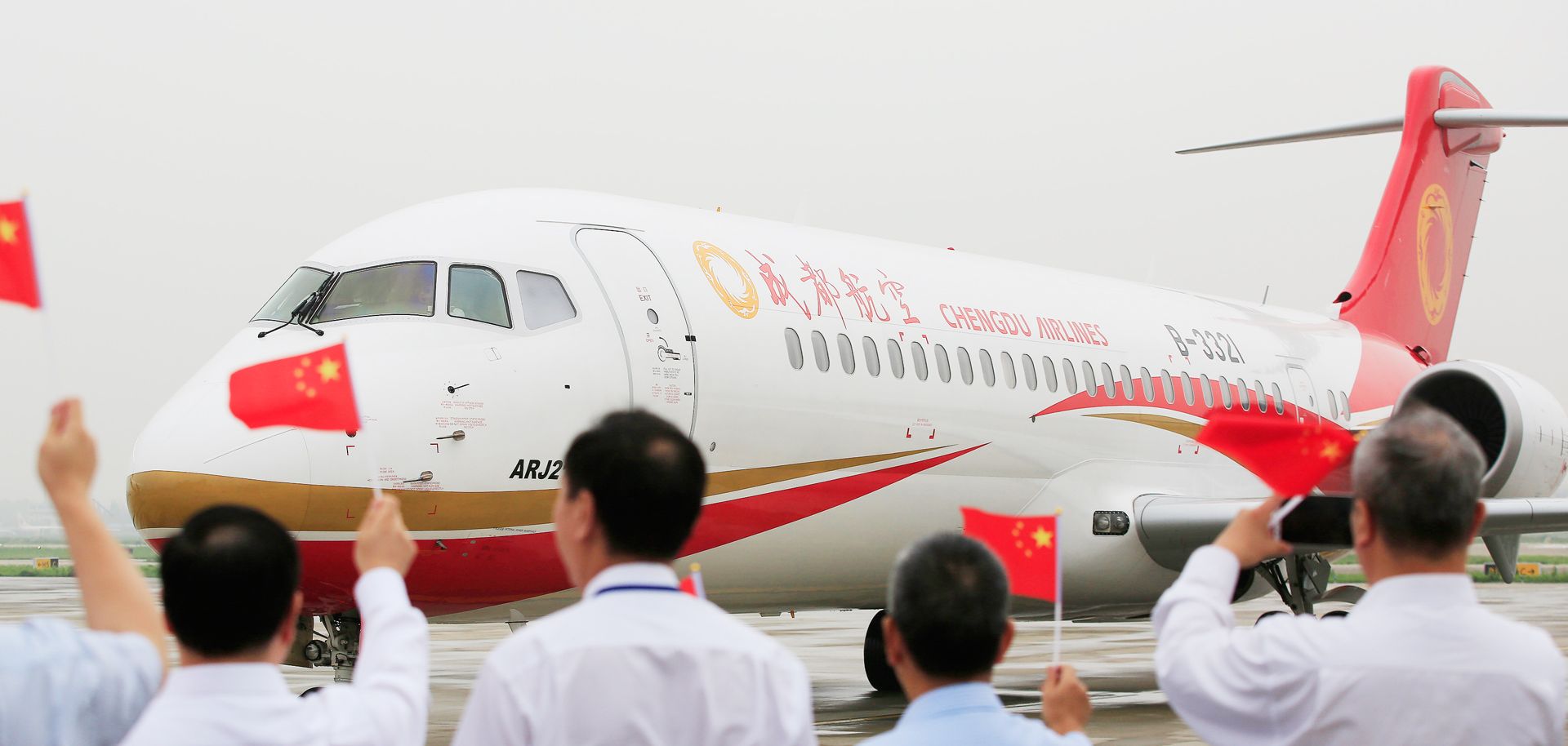

As regional and global demand for air travel increases, China and Japan are working to carve out their niche in the civilian aviation market.

(ALY SONG/AFP/Getty Images)

Subscribe Now

SubscribeAlready have an account?