ASSESSMENTS

Brazil Digs Itself a Deeper Hole

May 19, 2017 | 16:22 GMT

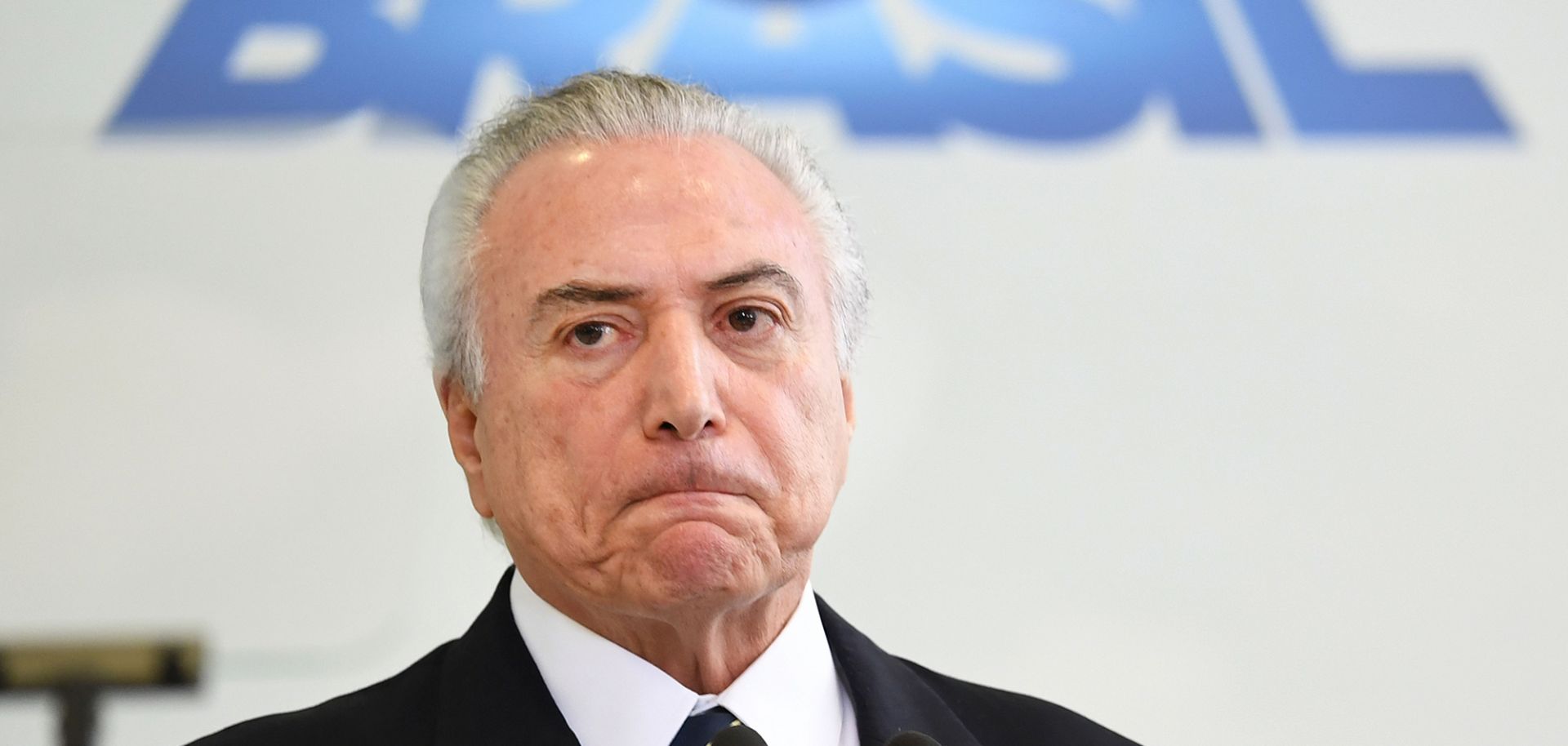

(EVARISTO SA/AFP/Getty Images)

Summary

An end to Brazil's plunge into political instability is not yet on the horizon, which means a sustained economic recovery may not be either. A new obstruction of justice scandal has engulfed Brazilian President Michel Temer and his close allies in Congress at a time when the Brazilian economy was just beginning to climb out of two years of deep recession.

On May 18, Brazilian Supreme Court judge Edson Fachin authorized an investigation into allegations that Temer sought to bribe a former lawmaker who has been threatening to implicate the president in various corruption scandals. The accusations stem from reports a day earlier, which claimed that the president had been caught on tape authorizing the chairman of Brazil's JBS meat-packing company, Joesley Batista, to pay hush money to former lower house speaker Eduardo Cunha, who has been imprisoned for corruption since November 2016 and has tacitly threatened to help prosecutors build a case against Temer in exchange for a plea bargain.

The audio quality of the recording, which was released on May 18, is poor, and Temer does not appear to explicitly direct Batista to buy Cunha's silence. But there were clearer parts in which Batista discussed other ways to interfere in the corruption probe with Temer. Though the president is defiantly shunning calls for his resignation, widespread suspicion of Temer's wrongdoing, combined with the potential for a lengthy probe into the matter, is likely to weaken him. Culture Minister Roberto Freire has already resigned, and other Temer allies will have cause to leave the ruling coalition as well. Meanwhile, street protests against Temer are expected to grow, and at a minimum Temer will lose congressional backing for important economic reforms needed to sustain the country's recovery.

Subscribe Now

SubscribeAlready have an account?