The recent fluctuations in China's currency typify the best and worst of a globalized world, where developments in one place can instantly change the political and financial calculations of governments in others. In search of stability, China has tied its currency to the U.S. dollar since 1994, usually at a low value relative to the dollar. During the 2000s, the connection helped China keep its exports competitive, with the developed world consuming its output. The West's economic collapse in 2008 meant that this model could no longer function, and China began trying to grow consumption levels so that the domestic consumer might come to fill the hole left by the faded international market.

Transforming from an export-led economic model to a consumption-led one could be described as changing from being like Germany to being like the United States, and China has tried to reproduce some of the advantages that the United States has created for itself in the same role. One of those advantages is the dominant position of the U.S. dollar in world trade, which means U.S. consumers can go deeply into debt and global demand for dollars will delay the moment at which this comes to a head by those debts being catastrophically called in. Thus China sought to grow international usage of the yuan, making strides in its attempts to do so. The next step would be for the yuan to be accepted into the International Monetary Fund's "currency," the Special Drawing Right.

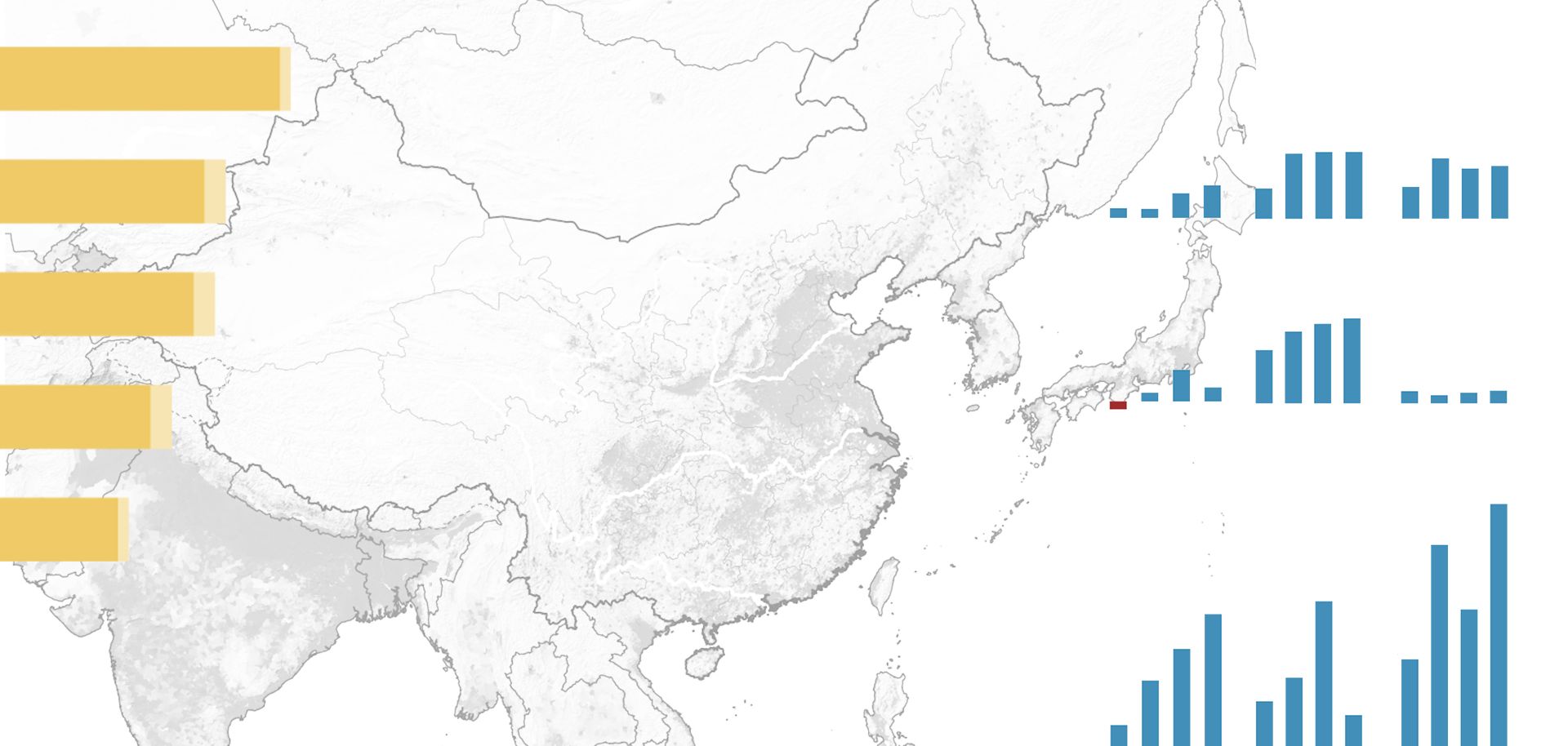

Meanwhile, the peg to the dollar aided China's strategy as the strengthening dollar over the past two years enabled the yuan to rise alongside it relative to the world's other floating currencies, empowering Chinese consumers and helping the changeover from an export- to consumption-based economy. But low global demand has not created a good climate for such change, and growth has been unsteady during this period, slipping to 7 percent this year. The baton pass from an export-driven to consumption-driven economy is risky, and exports need to hold up long enough for the Chinese consumer — and building blocks such as the reserve currency — to develop.