ASSESSMENTS

China's Corporate Reform Yields a Different Kind of Profit

Aug 20, 2017 | 13:05 GMT

Over the past few decades, China's state-owned companies have racked up debt faster than they can pay it off.

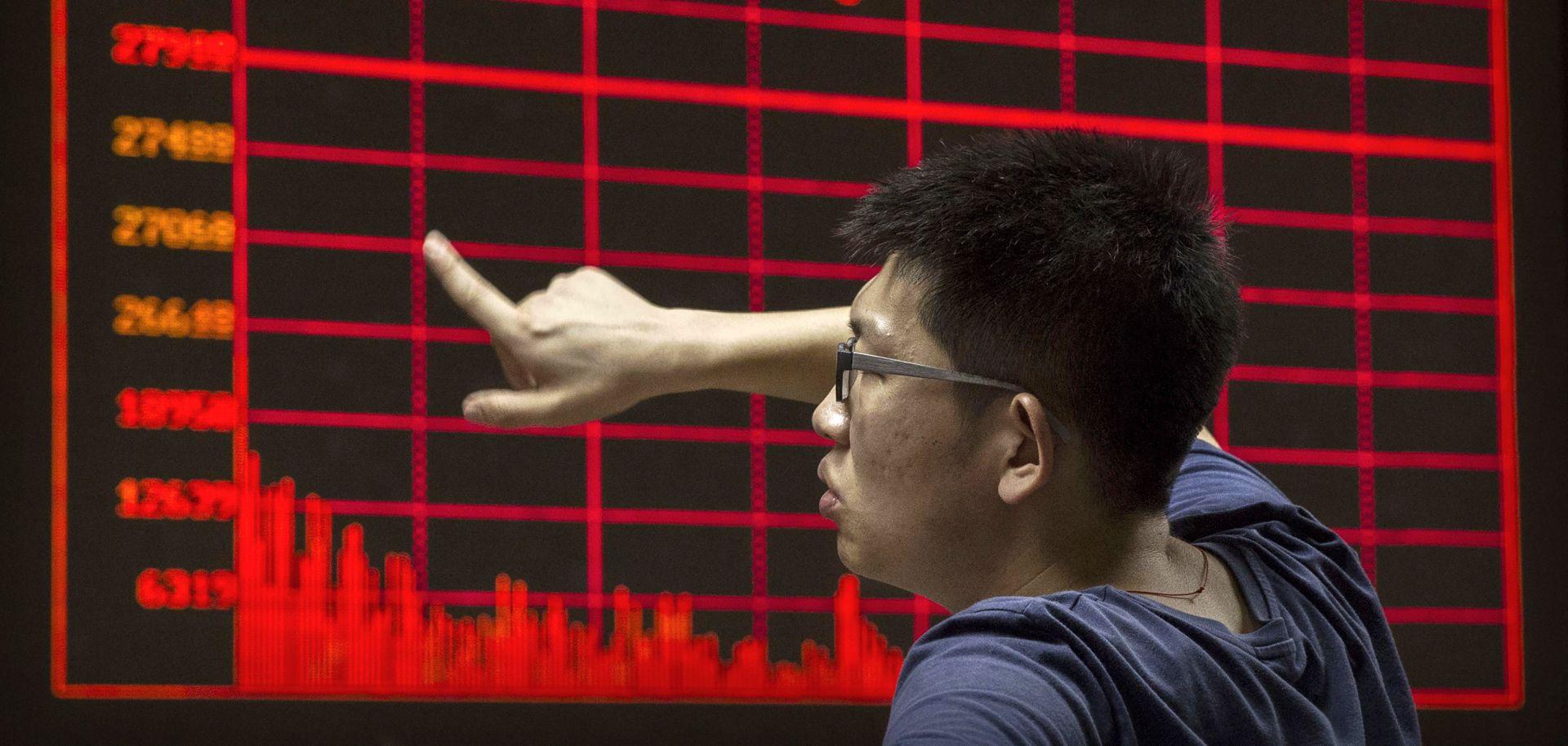

(KEVIN FRAYER/Getty Images)

Highlights

- Chinese state-owned enterprises (SOEs) in industries that hold the bulk of the country's outstanding corporate debt, such as steel, construction and real estate, will bear the brunt of a sustained slowdown in the real estate sector.

- A larger debt-for-equity swap program will allow SOEs to offload bad loans, but it could prove to be an expensive solution if managed improperly.

- Politicians, particularly at the local level, will advocate mergers among China's large but heavily indebted firms as a less disruptive alternative to declaring bankruptcy.

- China's push to reform its foundering SOEs is less about corporatization than it is about strengthening state-owned industries — and by extension, the Communist Party's hold over the country's political economy.

Subscribe Now

SubscribeAlready have an account?