ASSESSMENTS

The Double-Edged Sword in Brazil and Colombia's Presidential Elections

Jan 10, 2018 | 14:44 GMT

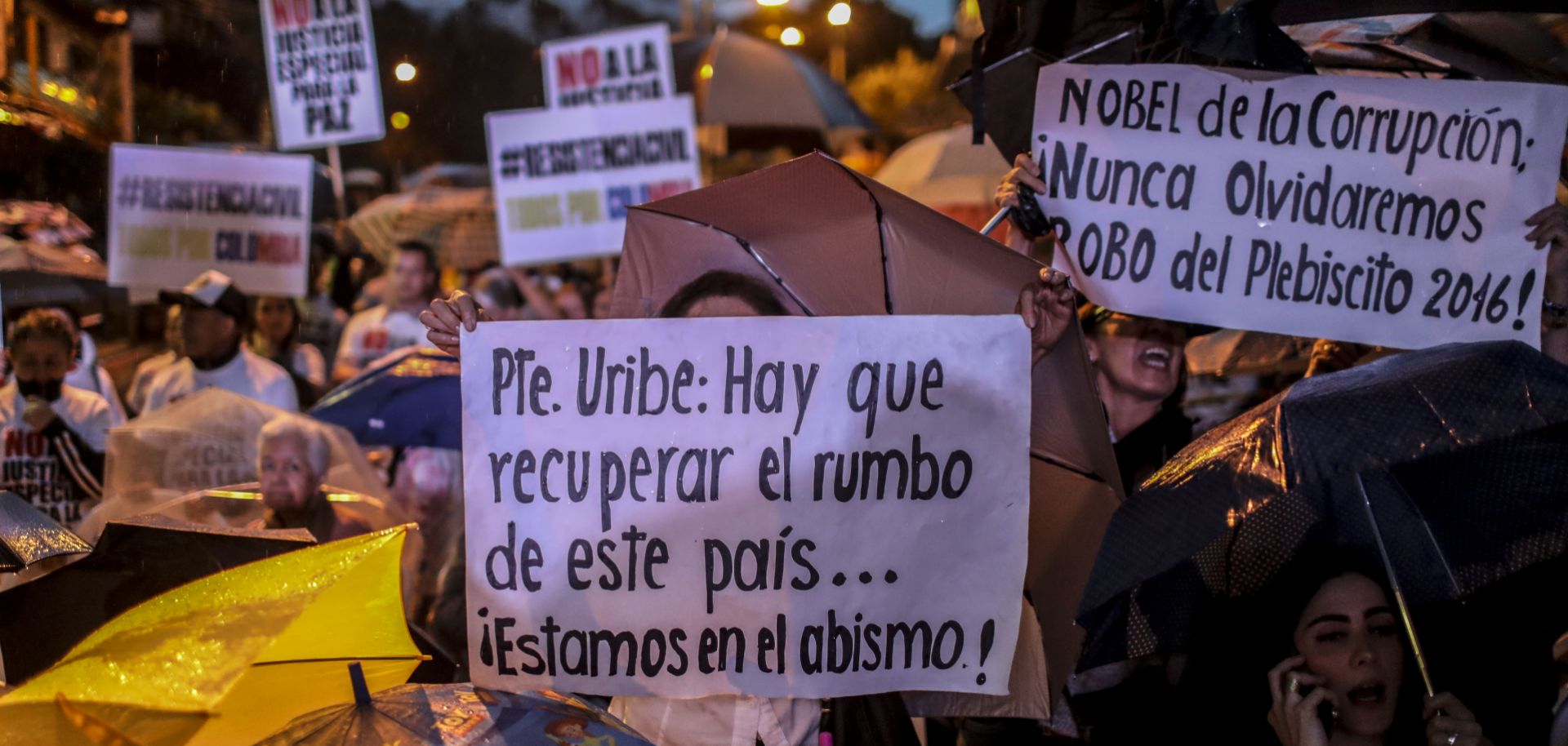

Supporters of current senator and former Colombian President Alvaro Uribe attend a rally with presidential candidates from Uribe's coalition in Medellin on Oct. 2, 2017. This year's presidential elections in Brazil and Colombia promise to be like no other in Latin America.

(JOAQUIN SARMIENTO/AFP/Getty Images)

Highlights

- Corruption scandals and economic slowdown have caused popular disillusionment with the traditional political parties in Brazil and Colombia.

- Distrust toward established parties has exacerbated political fragmentation, raising the prospect that the candidates of small political parties could win presidential elections in both countries this year.

- Front-runners from small parties will need to build coalitions in Congress if they are to head off the prospect of impeachment spearheaded by hostile legislatures.

Subscribe Now

SubscribeAlready have an account?