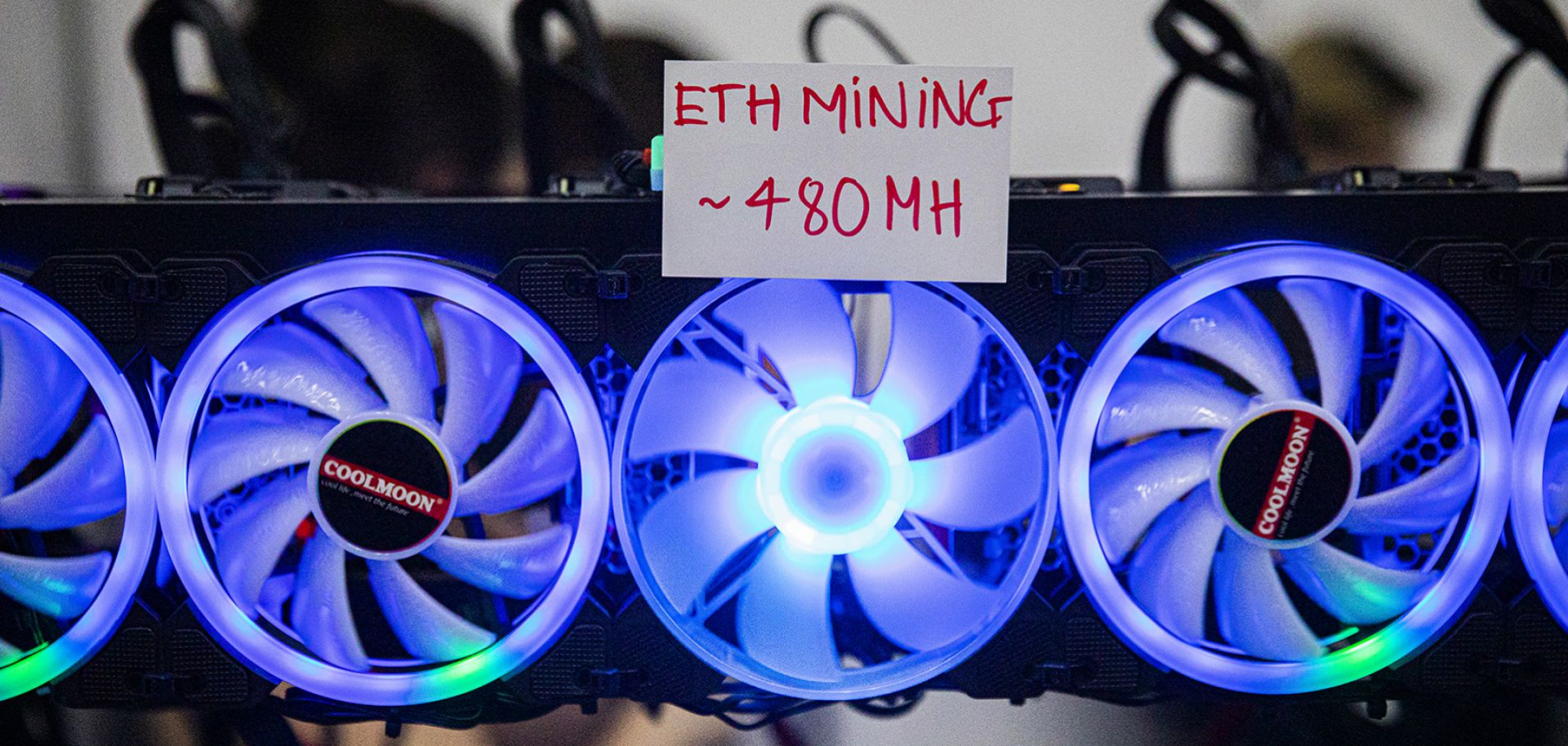

"The Merge" by the ethereum blockchain is the first major cryptocurrency to shift away from the computing- and energy-intensive "mining" process for data validation to one that is more sustainable. On Sept. 15, the ethereum blockchain finally merged with a different blockchain that shifts the currency's blockchain validation method away from a so-called proof-of-work to a proof-of-stake consensus algorithm for validation. In the more widespread proof-of-work method, computers essentially compete to be the first to solve complicated mathematical equations to "validate" a new block in a blockchain and earn cryptocurrency to do so. For extremely popular cryptocurrencies like ethereum and bitcoin — which respectively have about $200 billion and $400 billion of currency in circulation based on current prices — this has led to an arms race among blockchain miners to use more processing power — and more energy — to more frequently win the race to solve those equations. The high power consumption of the proof-of-work model has led to concerns about the carbon footprint and scalability of cryptocurrencies, as the bitcoin blockchain alone uses an estimated 150 terawatt hours of electricity annually — equivalent to the annual energy consumption of Argentina, one of the world's Group of Twenty leading economies.

Proof-of-stake algorithms promise to dramatically reduce power consumption and the energy footprint of the cryptocurrencies and distributed ledger technologies that use them. Ethereum's energy usage is expected to decline by around 99.9% because under a proof-of-stake model, there is no competition among miners to solve equations, nor is there an arms race to gain computer power. Instead, the algorithm chooses the "winner" based on a user's stake (i.e. the amount of the cryptocurrency the user has). In the case of the new ethereum algorithm, it randomly selects a user that has at least 32 ether (about $50,000) based on the overall amount of the currency the user holds to calculate the next block in the blockchain, and then the other validators (i.e. those with at least 32 ether) check the user's work to see if it is accurate. Once a certain number of other validators agree that the user's calculations are accurate, the original winner gains a transaction fee similar to what miners earn in other algorithms.

Proponents of the proof-of-stake algorithm point to its ability to scale up without environmental impacts and that the "stake" aspect improves security because those most heavily invested in the currency have an incentive to protect it, but opponents point out its untested nature and propensity to centralize power. Thus far, the security aspect of the proof-of-stake algorithm has not been tested on a widely-used cryptocurrency, as ethereum is the largest one to test it thus far. Proponents of the new algorithm point out that the only way to carry out a so-called 51% attack on the blockchain — that is, for a threat actor to control or collude with more than half of the validators to insert fraudulent transactions — would be by controlling more than half of the currency, which is exceedingly difficult given ethereum's $200 billion market capitalization. By contrast, in an attack on a proof-of-work algorithm, attackers would need only to control 51% of the processing power validating blocks. While this may seem large, just three mining pools (groups of users that work together and share bitcoins mined evenly) control more than 50% of the current hash rate for bitcoin mining. Finally, opponents of the proof-of-stake algorithm point out that the validation process rewards large users and that over time this will result in wealth concentration among those holding a lot of the currency, an argument that will be tested in the future.