REFLECTIONS

Greece and Argentina, Similar But Not the Same

Feb 11, 2015 | 00:14 GMT

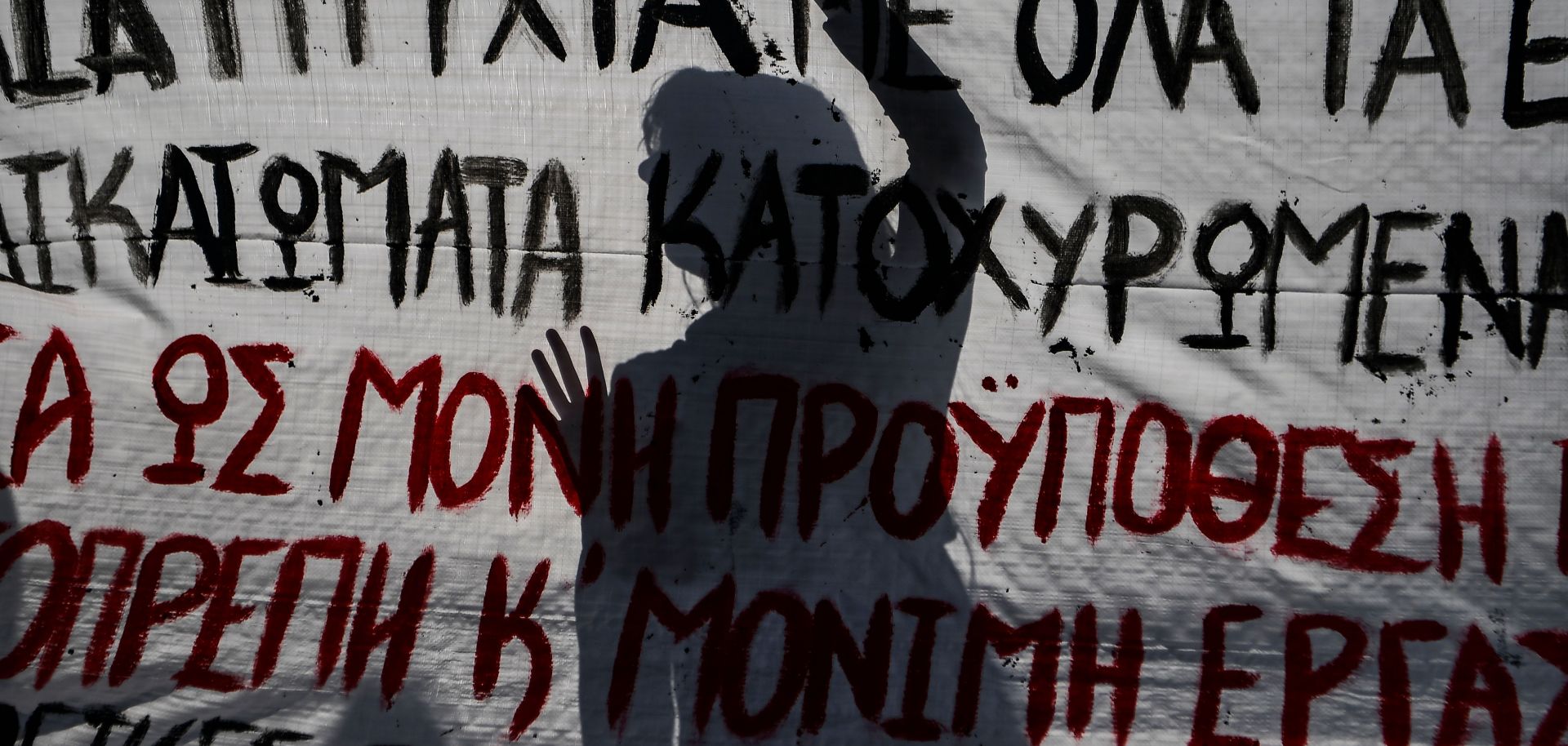

A student silhouette is seen behind a banner as he takes part in a rally in central Athens, on November 14, 2018, during a demonstration marking the civil servants 24-hour strike against government's economic policies and high unemployment.

(ARIS MESSINIS/AFP/Getty Images)

Subscribe Now

SubscribeAlready have an account?