ASSESSMENTS

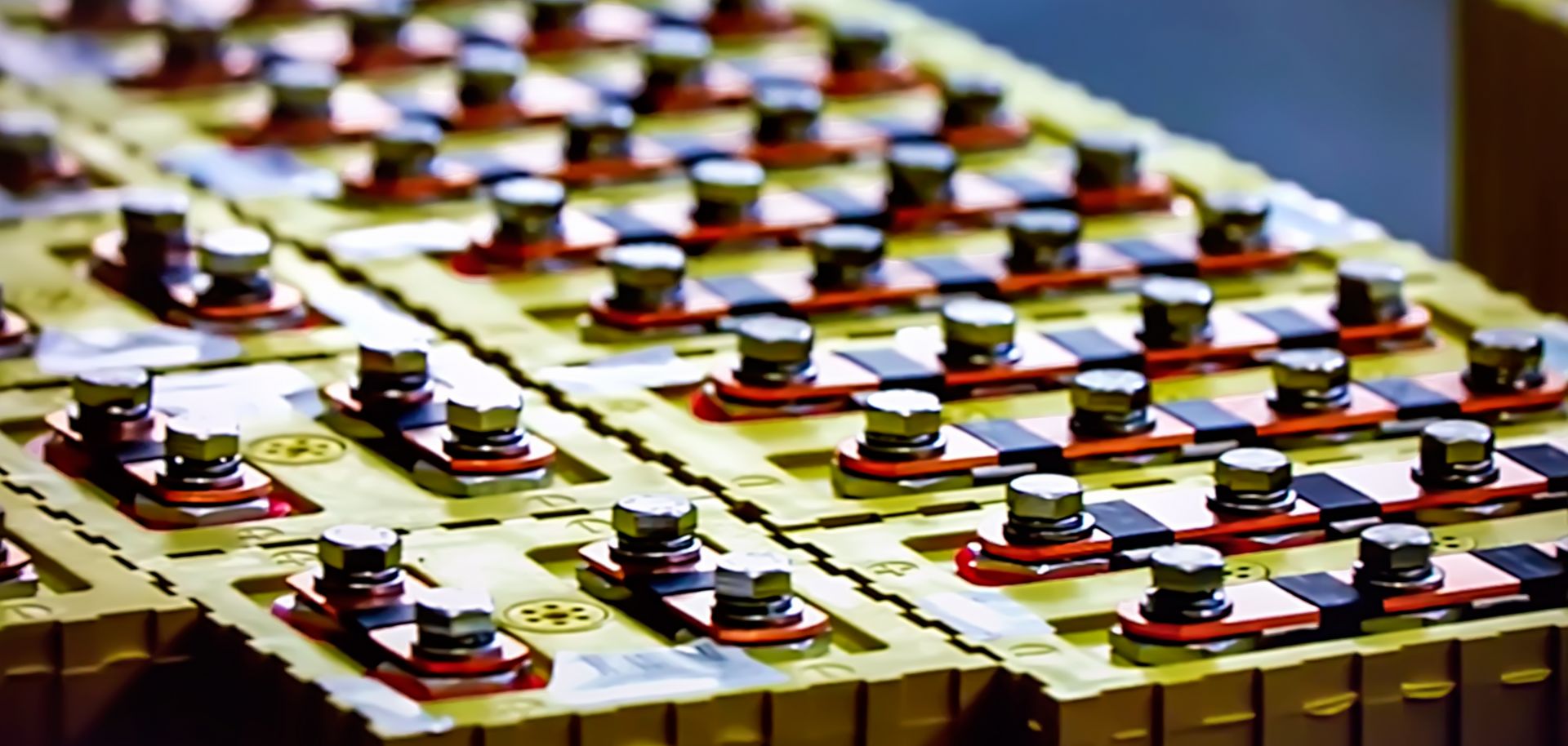

How China Is Muscling In on Lithium-Ion Batteries

Jul 5, 2018 | 09:00 GMT

As it makes changes to its economy, China is intent on ensuring greater control over the entire supply chain for lithium-ion batteries for years to come.

(Shutterstock)

Highlights

- In spite of potential global pushback against Beijing's investments, Chinese companies will acquire control of a majority of the lithium-ion battery market, giving the country a significant advantage in a sector of growing geopolitical importance.

- The United States will exploit economies of scale and focus on finding domestic sources of materials as it attempts to carve out a market share amid China's growing dominance.

- Japan and Korea will have the most success penetrating markets in which there is significant pushback against Chinese investment, such as in North America, Australia and parts of Europe.

- Europe will likely fall behind because its battery manufacturing capacity does not have the ability to meet its demand.

Subscribe Now

SubscribeAlready have an account?