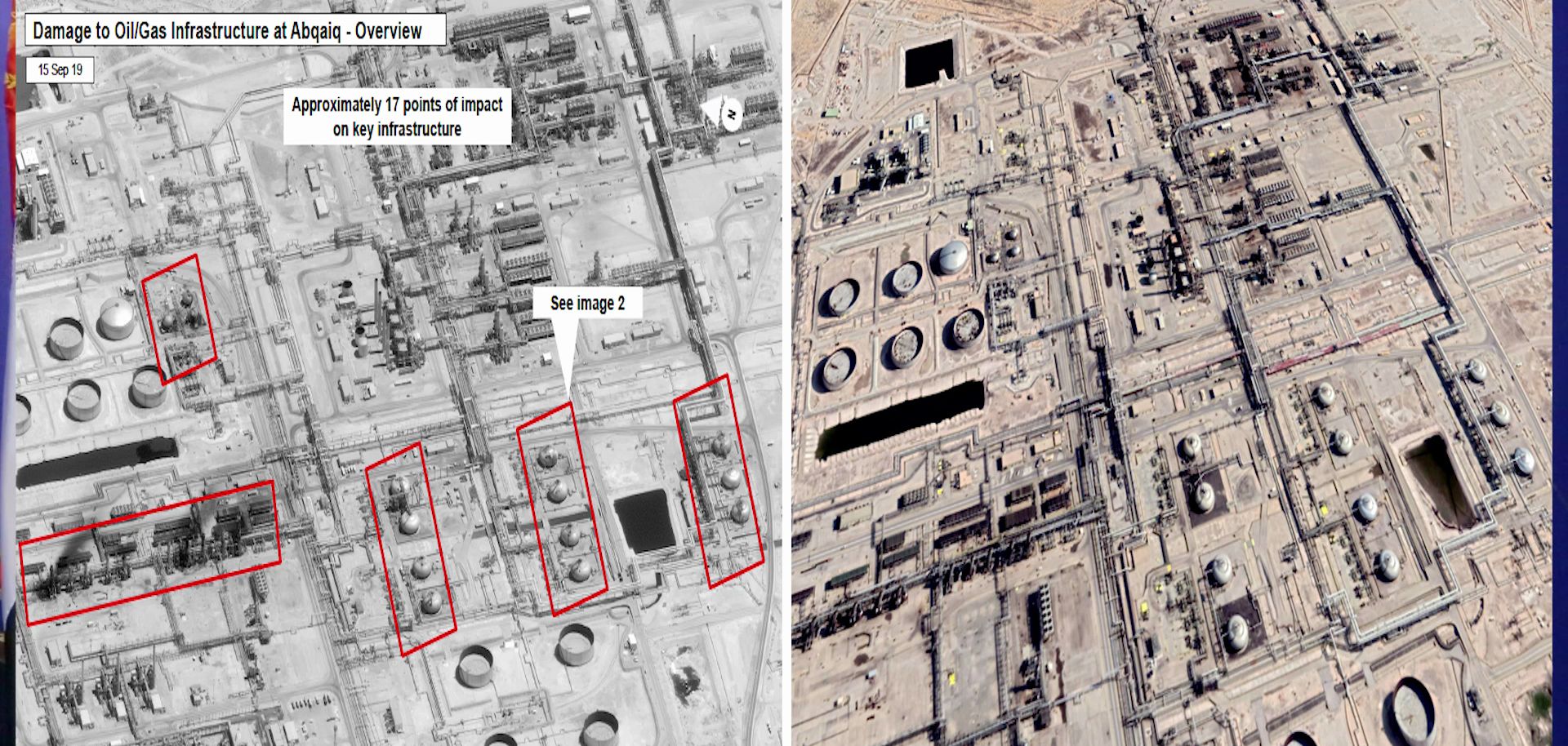

On Sept. 14, Saudi Arabia suffered its most significant attack since armed militants ambushed the Grand Mosque in Mecca nearly 40 years ago. The 1979 Grand Mosque seizure shaped Saudi Arabia's strategic perception of the world and its rivalry with Iran. And Tehran's recent strike on Riyadh's Abqaiq and Khurais oil processing facilities will do the same. The question is how.

To protect its vital oil sector, Saudi Arabia is now undoubtedly mulling several different options of both escalation and de-escalation with Iran. Though based on powerful Crown Prince Mohammed bin Salman's past actions and outspoken criticism of Tehran, the former may be most likely.

...