ASSESSMENTS

In India, Modi Tackles the Economy Alone

Jul 15, 2016 | 09:02 GMT

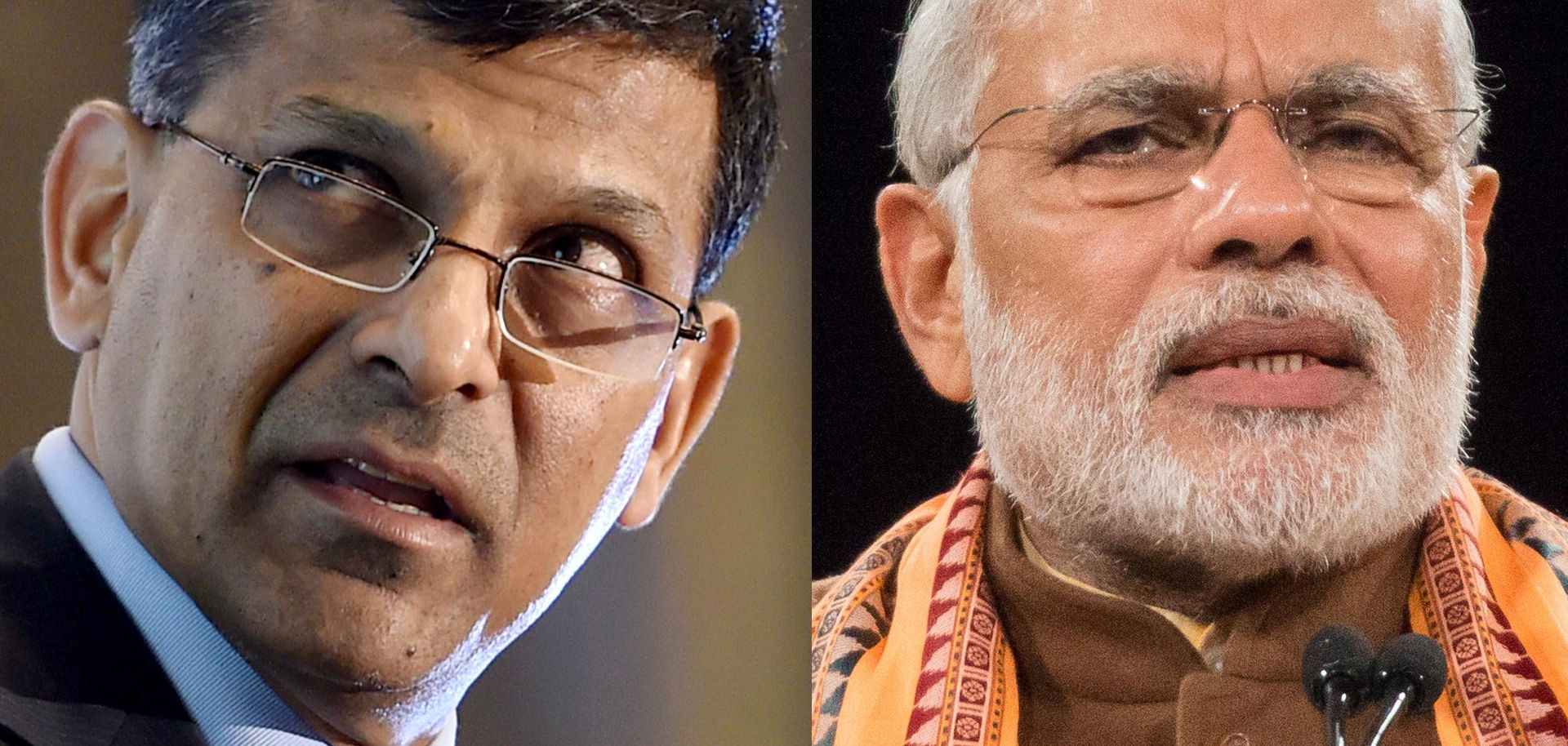

(GEOFF ROBINS/MANJUNATH KIRAN/AFP/Getty Images)

Summary

India's economy is a study in contradiction. It is the fastest growing economy on Earth, and yet it cannot produce enough jobs to lift a quarter of the world's poor out of India's dusty villages and sprawling urban slums. It boasts the second-largest labor pool, yet roughly half those workers are mired in an agricultural sector that contributes less than 16 percent of the country's gross domestic product. It attracted $44 billion in foreign direct investment last year — the 10th-largest inflow in the world — and yet its business environment continues to be hobbled by bureaucracy, corruption and bribery.

Steering an economy such as India's toward growth and stability is no small feat, but that has not stopped Prime Minister Narendra Modi and Reserve Bank of India Gov. Raghuram Rajan from trying. The two men have different ideas about how to get the Indian economy back on track, however. Unable to reconcile those differences, Rajan recently announced his intention to step down in September, leaving Modi to tackle one of the country's biggest problems alone.

Subscribe Now

SubscribeAlready have an account?