ASSESSMENTS

Iraq Faces America's Economic Wrath

Jan 14, 2020 | 10:00 GMT

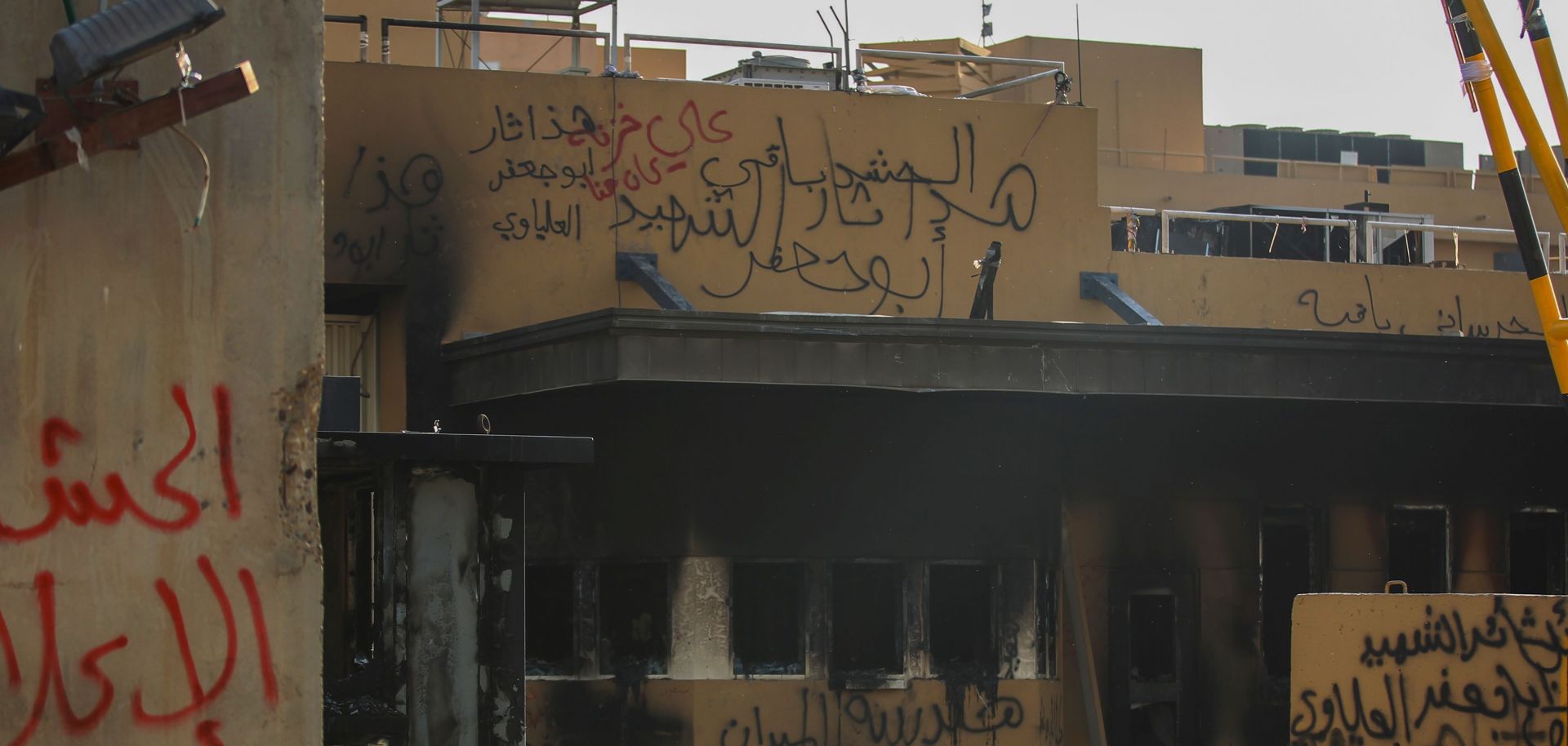

The U.S. Embassy in Baghdad is seen on Jan. 2, 2020, following an attack on the facility. If Iraq pushes U.S. troops to leave, the country will find itself in America's economic crosshairs.

(AHMAD AL-RUBAYE/AFP via Getty Images)

Highlights

- Washington will tighten the enforcement of its existing sanctions on Iran and Iranian proxies in Iraq, meaning more companies, banks and individuals will fall afoul of U.S. measures.

- The United States will probably expand its sanctions beyond just Iranian-backed militias in Iraq to target pro-Iran politicians directly.

- The country could impose limited economic sanctions on Baghdad, but only in the event that it is forced to remove its troops from Iraq.

- The United States is likely to tailor any economic sanctions so as to hurt Iraq's economic future rather than inflict immediate significant economic harm — the latter of which would only occur should American forces suffer significant casualties in the pullout.

Subscribe Now

SubscribeAlready have an account?