ASSESSMENTS

For Malaysia's Ruling Coalition, the Honeymoon's Over

Jun 19, 2019 | 09:00 GMT

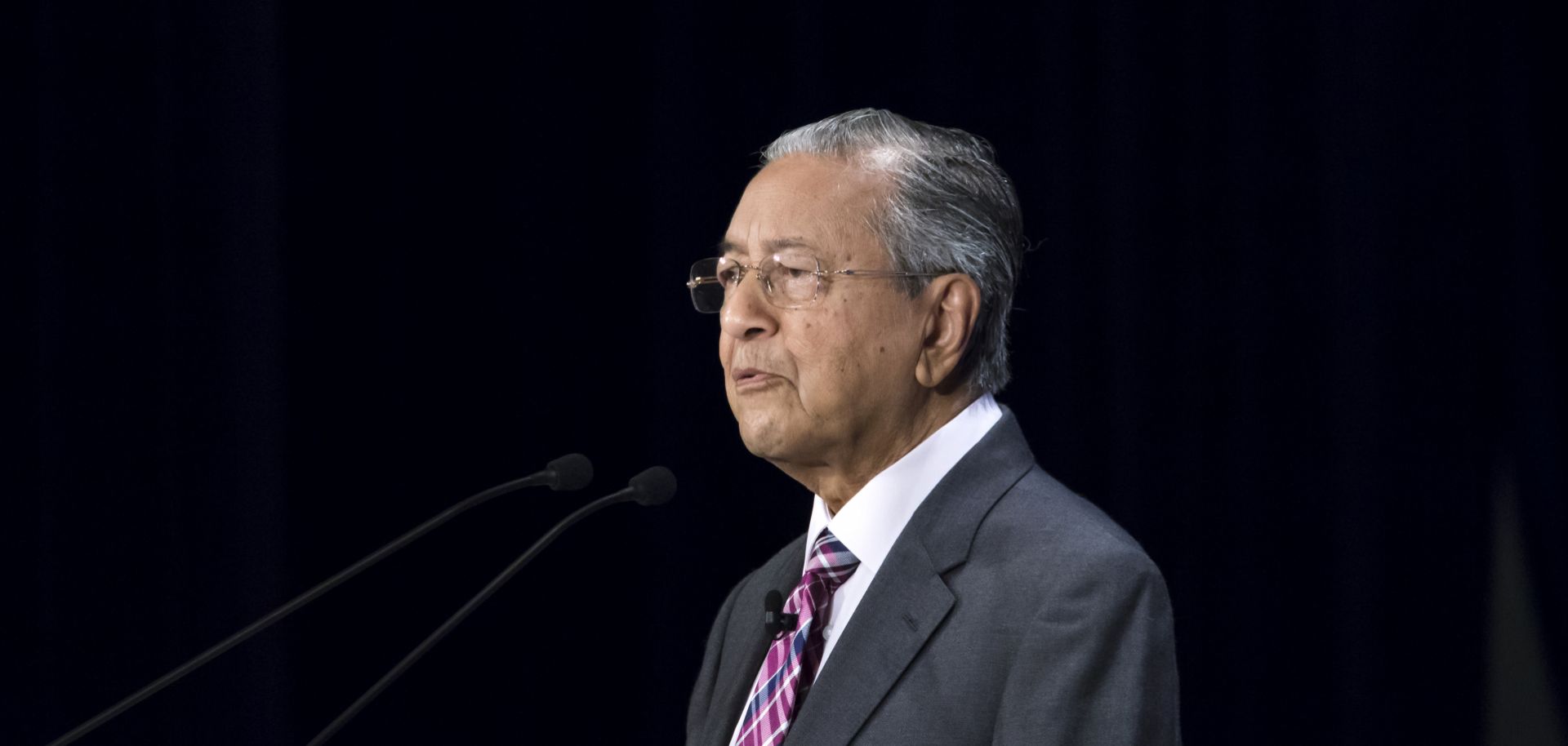

Economic, political and academic leaders from the Asia-Pacific region, including Malaysian Prime Minister Mahathir Mohamad, recently gathered in Tokyo for the 25th International Conference on the Future of Asia to discuss regional issues, as well as Asia’s evolving role in the world.

(TOMOHIRO OHSUMI/Getty Images)

Highlights

- The newly minted status of Malaysia's ruling Pakatan Harapan coalition, along with the deeply entrenched power networks of the preceding Barisan Nasional coalition, will limit the government's ability to pursue its policy agenda in the coming years.

- The next national election is still four years away, though inner splits and disruptions over a promised prime ministerial handover could still jeopardize the coalition's agenda before then.

- While Malaysia's 2018 economic picture was relatively bright overall, modest upticks in growth are unlikely to outweigh voters' discontent with the government's perceived failure to deliver on its promise of wider economic prosperity.

Subscribe Now

SubscribeAlready have an account?