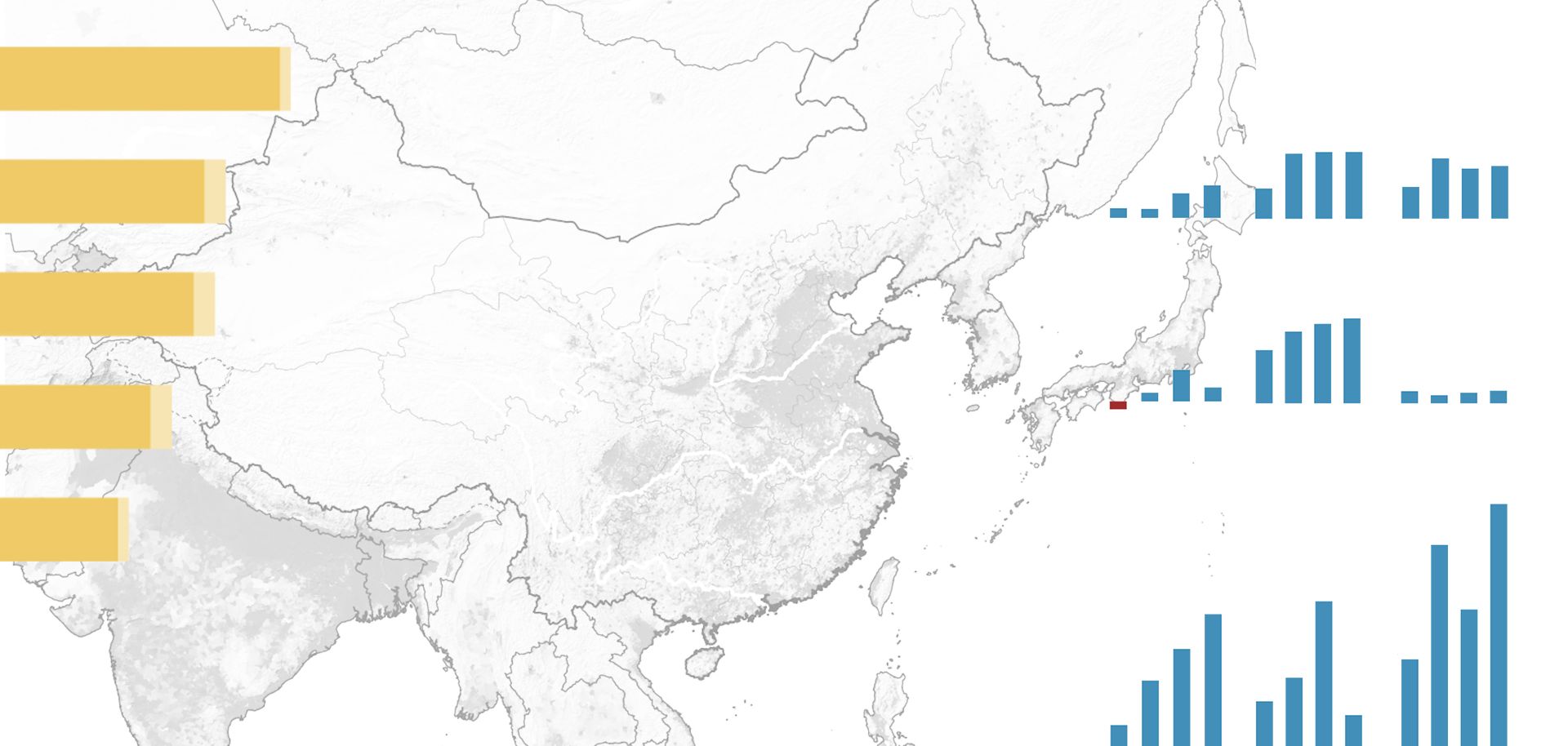

Shipbuilders and shipbreakers will play an important role in correcting the imbalance in the shipping industry. Orders for the construction of new container, bulk and tanker ships fell sharply in 2016, a dip that will help to address the shipping industry's problems but will damage the shipbuilding sector in the process. Though there is usually a two-year delay between the order of a new ship and its actual delivery, some shipyards have already finished filling the orders on their books. And with no new purchases on the horizon, many have had to shut their doors for good. Desperate to protect the industry vital to their economies, countries like Japan, South Korea and China will continue trying to attract buyers and bolster national shipbuilders, regardless of the fact that doing so would widen the shipping industry's supply and demand gap even more.

For the shipbreaking sector, on the other hand, 2016 was a banner year. More than 500,000 twenty-foot equivalent units' (TEUs') worth of cargo capacity was demolished in container shipping alone, much of which came from relatively new ships. Between the expansion of the Panama Canal, which led to an overabundance of Panamax-sized vessels, and the glut of ships on the market as a whole, companies that couldn't afford to maintain unused vessels were forced to scrap ships as young as 7 years old — a historical record. Countries with sizable scrapping industries, such as India and Bangladesh, welcomed the additional business, even if it was a product of international shipping companies' misfortune. But the boom of 2016 probably won't last for much longer, since companies can afford to get rid of only so many ships.

Dwindling purchases and heightened scrapping have yet to fully right the shipping industry. At the same time, they have put shipbuilders — which are crucial producers for many countries — in a difficult position. Without new vessels to build, shipyards have had a hard time staying up and running, even with the help of government subsidies. China Ocean Shipping Co., China's third-largest shipbuilder, will be closing three of its yards by 2020, while Mitsubishi Heavy Industries is weighing the possibility of restructuring its company. Hyundai Heavy and Daewoo Shipbuilding, moreover, may lower their prices to bring in more buyers. If they succeed, the addition of new ships to the global fleet may help keep shipping rates low — at the industry's expense.

Nevertheless, companies in search of new ships must be able to find the capital with which to buy them. Firms also have to meet their payments on existing loans, a reality that inextricably links them to the world's banks. Because German banks own roughly a quarter of the container shipping industry's outstanding loans, they are particularly vulnerable to the sector's financial troubles. And with the country's crucial elections set for later this year, German banks will no doubt take steps to protect themselves from default, choosing policies that best suit their interests rather than the shipping industry's.