ASSESSMENTS

In Papua New Guinea, Reality Will Dim Any Nationalist Dreams

Sep 6, 2019 | 09:00 GMT

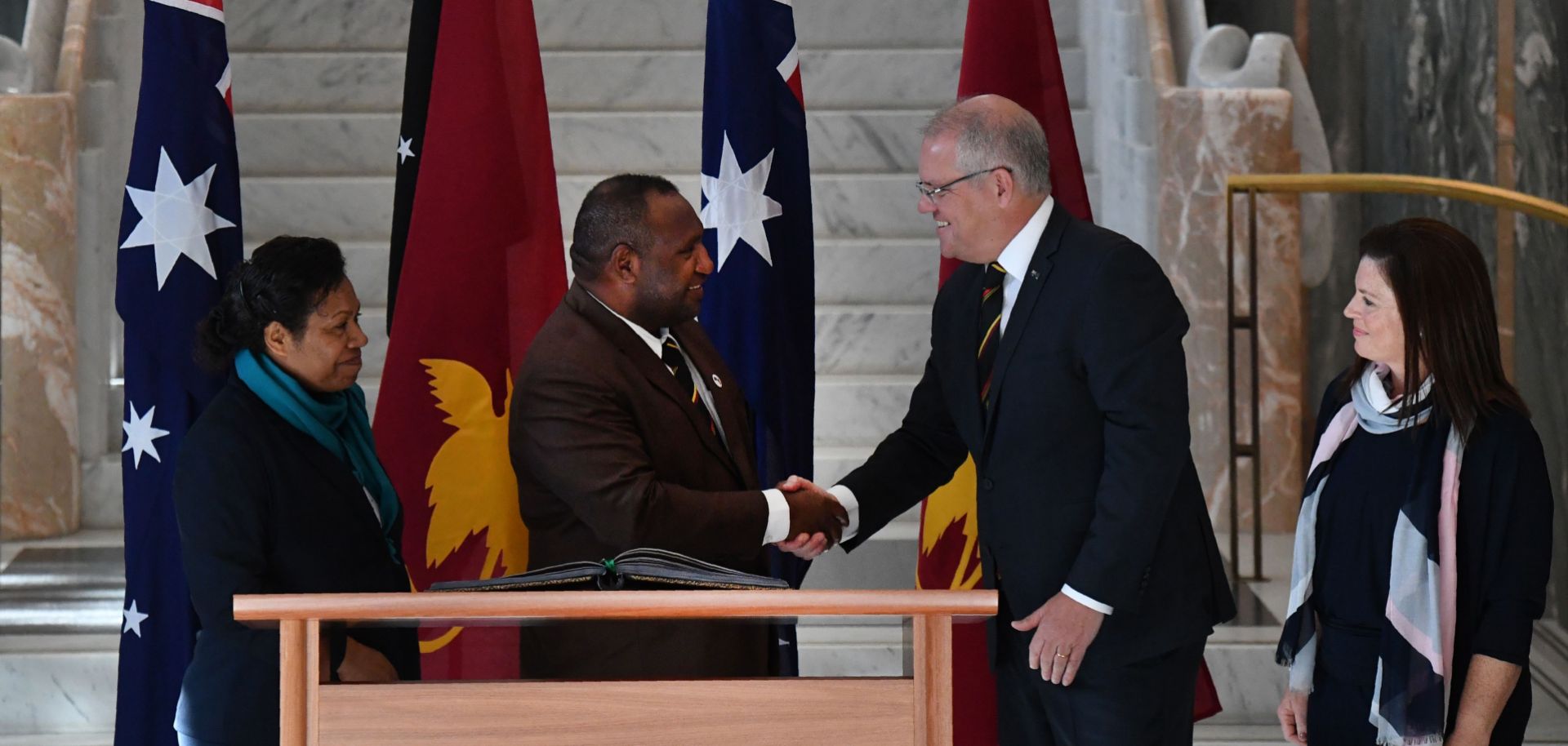

Papua New Guinea's Prime Minister James Marape (left) shakes hands with Australia's Prime Minister Scott Morrison as their wives look on in Canberra during July.

(MICK TSIKAS/AFP/Getty Images)

Highlights

- Papua New Guinea's small size and dependence on oil and gas extraction will limit Prime Minister James Marape's ability to win more beneficial deals without alienating foreign investment.

- To mitigate the country's massive debt, Marape has also waded into great power competitions by appearing to openly court China for additional financial aid.

- But in doing so, he'll have to tread carefully to avoid running afoul of Australia, which remains the country's largest trade and investment partner.

- Meanwhile, Marape's political longevity is also in question given the country's deep internal fractures and no-confidence mechanisms that will come into play in late 2020.

Subscribe Now

SubscribeAlready have an account?