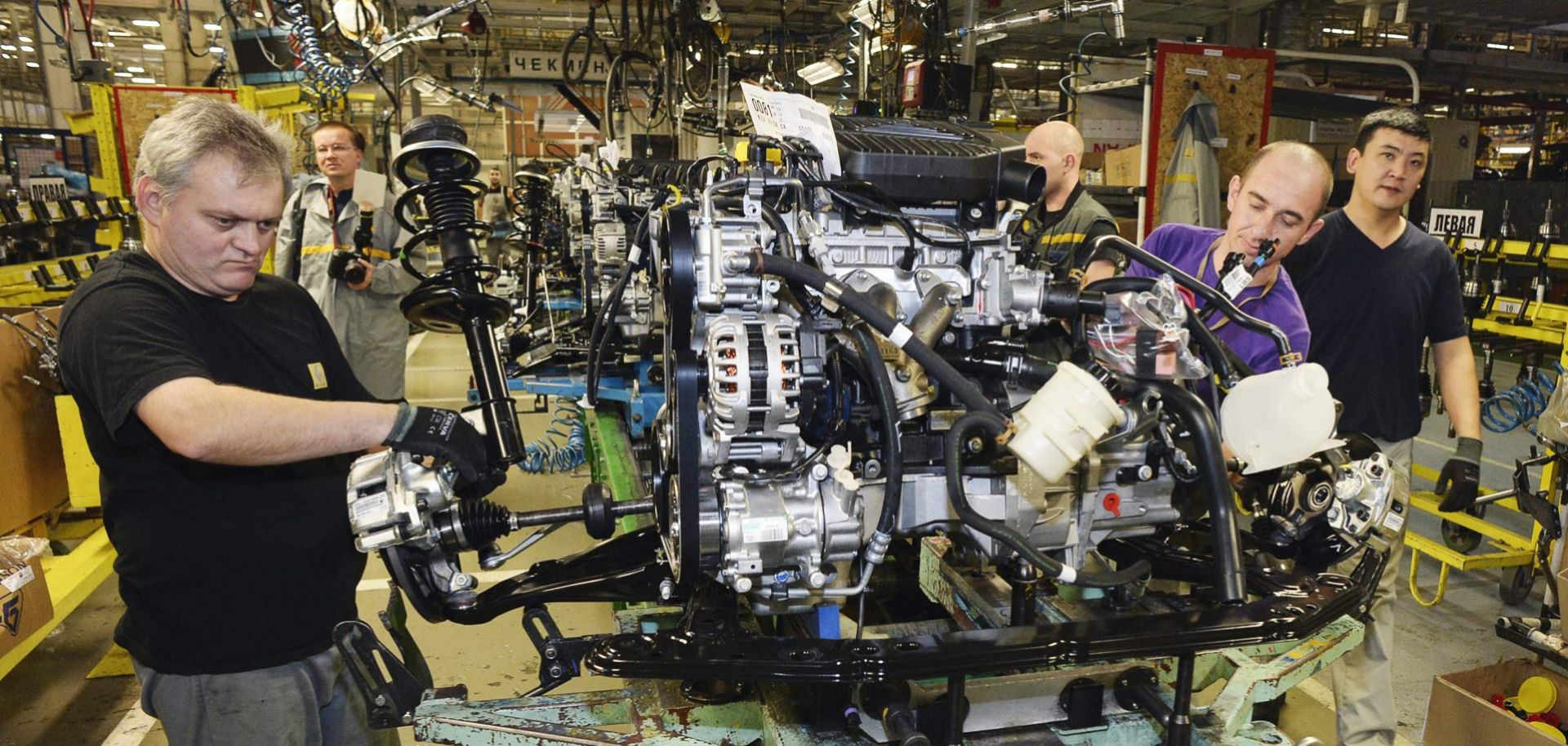

Russia's economic downturn has left many of the country's biggest companies struggling to make ends meet. Now, AvtoVAZ -- Russia's largest automobile manufacturer and the recession's latest victim -- is on the verge of laying off thousands of workers unless the Kremlin can find a way to prevent it. The company, which employs some 2 million Russians, intends to let some of its people go through a "voluntary" dismissal over the next two weeks, offering hefty compensation packages to those who leave. The announcement prompted the governor of the region housing AvtoVAZ's biggest plant to meet with Russian President Vladimir Putin on June 6 to ask for the government's help. But whether the Kremlin props up Samara province's unemployed automotive workers or pressures AvtoVAZ into keeping them, it will not be able to fix the worsening economic conditions that threaten citizens' livelihoods and, by extension, the legitimacy of...