ASSESSMENTS

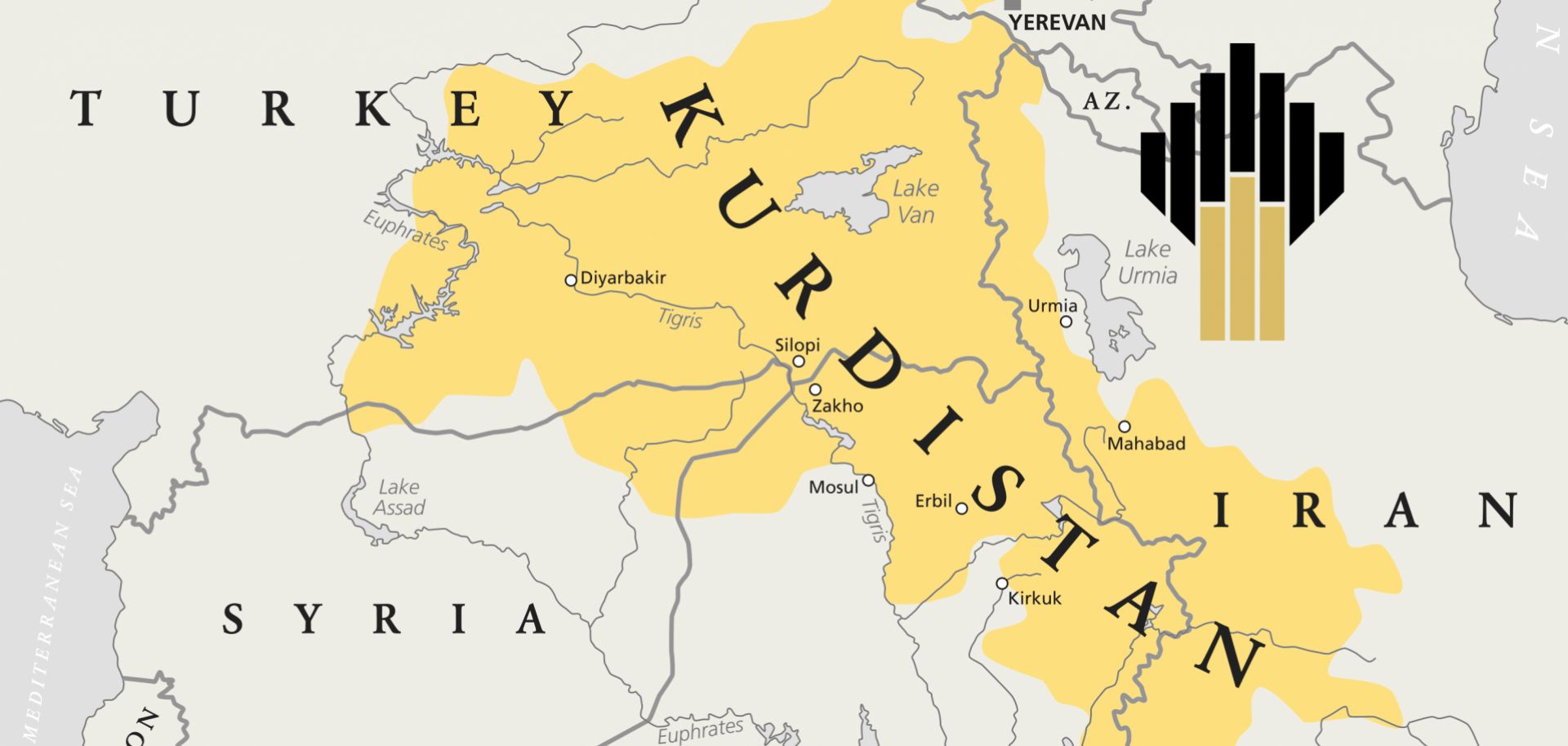

A Russian Energy Firm Boosts the Political Power of Iraq's Kurds

Sep 19, 2017 | 15:32 GMT

The natural gas export pipeline that Rosneft and the Kurdistan Regional Government are negotiating could immediately change the way regional powers operate and behave.

(PeterHermesFurian/iStock and DMITRY KOSTYUKOV/AFP/Getty Images)

Highlights

- Russian state energy firm Rosneft's relationship with Iraqi Kurdistan will expand dramatically with the construction of a natural gas pipeline to Turkey.

- Iraqi Kurdistan has relied on Turkey in the past to export its oil, but the new natural gas pipeline will increase Turkey's dependence on the autonomous region.

- Turkey will welcome an alternative to Iranian and Russian natural gas, though buying from the Kurds will limit its influence over them.

Subscribe Now

SubscribeAlready have an account?