REFLECTIONS

Saudi Arabia and Russia Negotiate From Opposite Sides of the Table

Oct 5, 2017 | 21:45 GMT

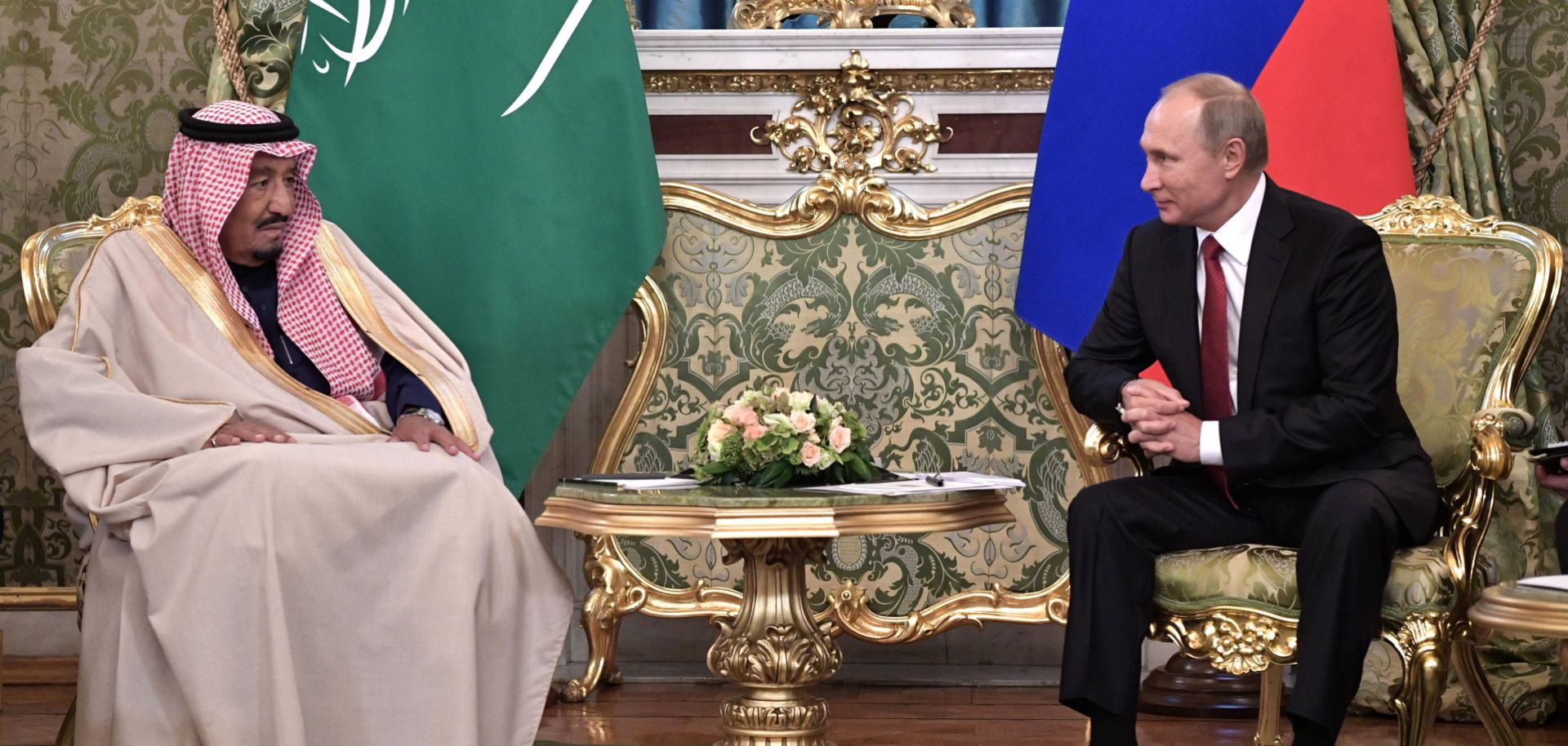

Russian President Vladimir Putin (R) meets with Saudi King Salman at the Kremlin in Moscow on Oct. 5, 2017. Saudi Arabia and Russia aren't on the friendliest of terms, but circumstances have aligned in such a way that each needs the other.

(ALEXEY NIKOLSKY/AFP/Getty Images)

Subscribe Now

SubscribeAlready have an account?