Since 2007, the world's available shipping capacity has grown at a faster pace than has global trade. Amid the explosion of trade that accompanied globalization, international shipping companies ordered the construction of new vessels — orders that were placed before the financial crisis of 2008-09 but weren't completed until after the downturn hit. Around the same time, the container industry began to advocate the use of bigger ships, arguing that they would boost efficiency and lower operating costs. (This logic holds only if the ships are fully utilized.) Thanks to the extra space the gigantic vessels provided, shipping costs and shipyard fees declined, encouraging companies to capitalize on low prices by buying even more vessels.

Their purchases exacerbated the world's ballooning overcapacity problem. By 2016, about 10 percent of the global shipping fleet was out of service, whether scrapped or laying idle, a record high in the industry. And despite the International Monetary Fund's expectations that the volume of global exports will rise by 3.5 percent this year (compared with only 2.2 percent last year), the shipping sector's excess capacity is unlikely to disappear by the end of 2017 as container space growth outpaces the uptick in shipping traffic once again.

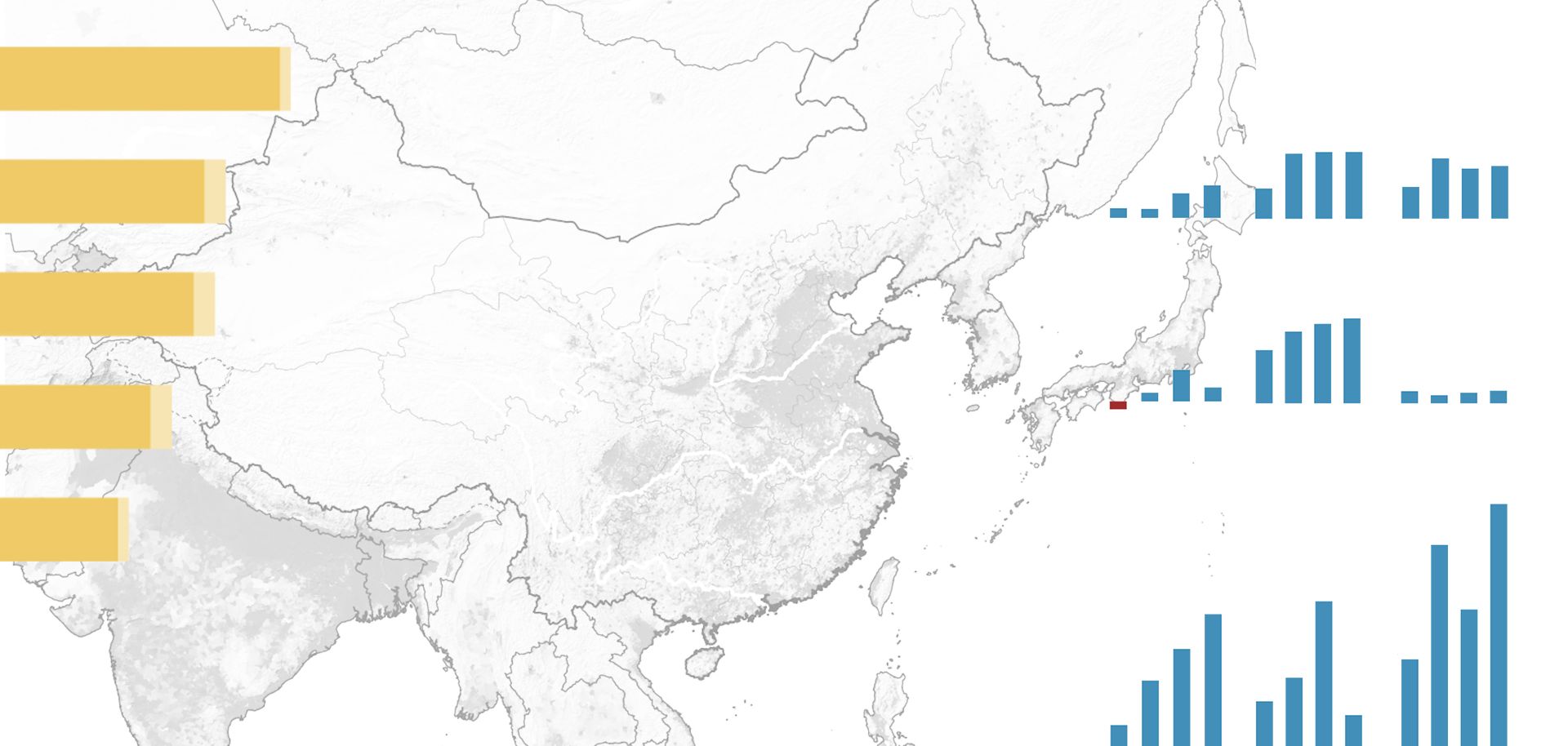

Carriers have had to ride out boom and bust cycles before. But the severity of the current downturn has spurred an unprecedented amount of consolidation in the industry as companies work to make better use of the larger, more efficient ships they ordered nearly a decade ago. Even so, these efforts were too little, too late for many firms, and in August 2016, Hanjin — one of the shipping industry's biggest carriers — filed for bankruptcy. Hanjin was not the only company in dire financial straits, though its high-profile collapse helped to shed light on just how long the industry's road to recovery would be. In fact, 18 major container carriers have seen their fortunes reversed over the course of the industry's downturn.

Corporate consolidation is expected to become more common this year, something industry experts say will be necessary to restoring balance to the shipping sector. If all of the mergers and acquisitions planned for 2017 are completed, only 13 major carriers will be left. Those firms may then choose to join forces with one another as a new set of cooperative deals comes into force on April 1. The alliances will doubtless make room for the more efficient use of the world's half-empty container ships. And as the world's oversupply of shipping capacity gradually shrinks, carriers will find some measure of financial relief as prices — and profits — begin to rebound. But the industry will still have to adapt to its new international environment.