ASSESSMENTS

With Turkish Stream, Gazprom Faces Major Obstacles

Jul 9, 2015 | 22:05 GMT

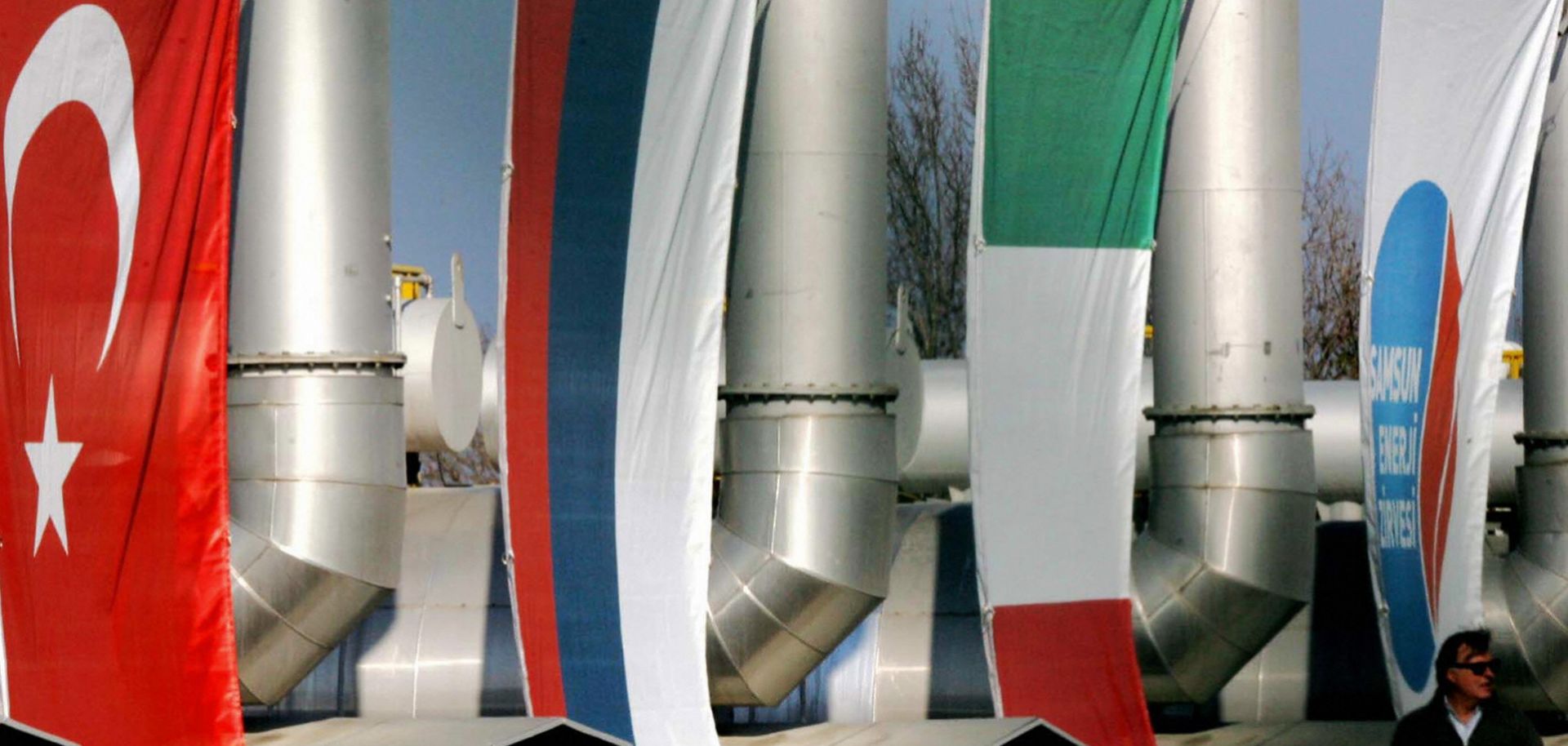

(MUSTAFA OZER/AFP/Getty Images)

Summary

For the second time this week, Russian energy firm Gazprom has announced the suspension of a contract to construct its planned Turkish Stream pipeline. First, on July 6, the company asked pipeline suppliers to suspend deliveries. Then it canceled a contract July 9 with Italian oil and natural gas contractor Saipem. The developments follow the passing of a June 29 negotiating deadline in talks over natural gas discounts between Turkey and Gazprom. The setbacks highlight the difficulty that Gazprom has had implementing the Turkish Stream project on schedule — and foreshadow future complications. Gazprom had planned to begin construction on the first phase of the pipeline, which involved Saipem. The completed first phase of the pipeline was then set to enter service by the end of 2016. With the latest cancellations and delayed talks with Turkey, that start date is now likely to be delayed.

Subscribe Now

SubscribeAlready have an account?