GUIDANCE

The Weekly Rundown: Belt and Road Forum, Signs of U.S. Change in Libya and Burying a South American Bloc

Apr 20, 2019 | 17:13 GMT

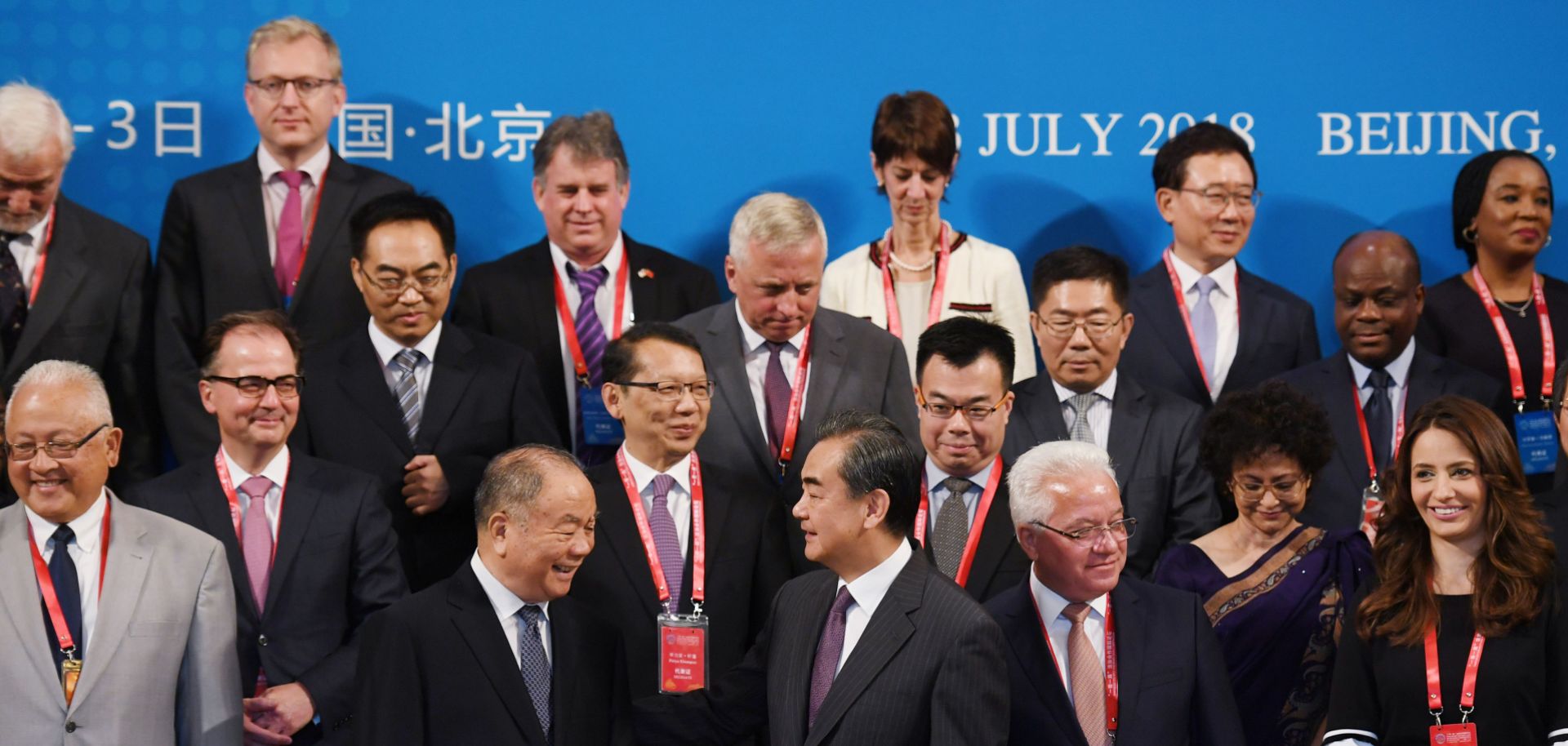

Chinese Foreign Minister Wang Yi, front center, stands with other delegates at the Belt and Road Forum on Legal Cooperation in Beijing on July 2, 2018. China's latest conference promoting its massive connectivity project opens April 25.

(GREG BAKER/AFP/Getty Images)

Subscribe Now

SubscribeAlready have an account?