GUIDANCE

The Weekly Rundown: Trump's Syria Pullout, Mattis' Exit; Mexico and Energy; and North Korean Nukes

Dec 22, 2018 | 19:38 GMT

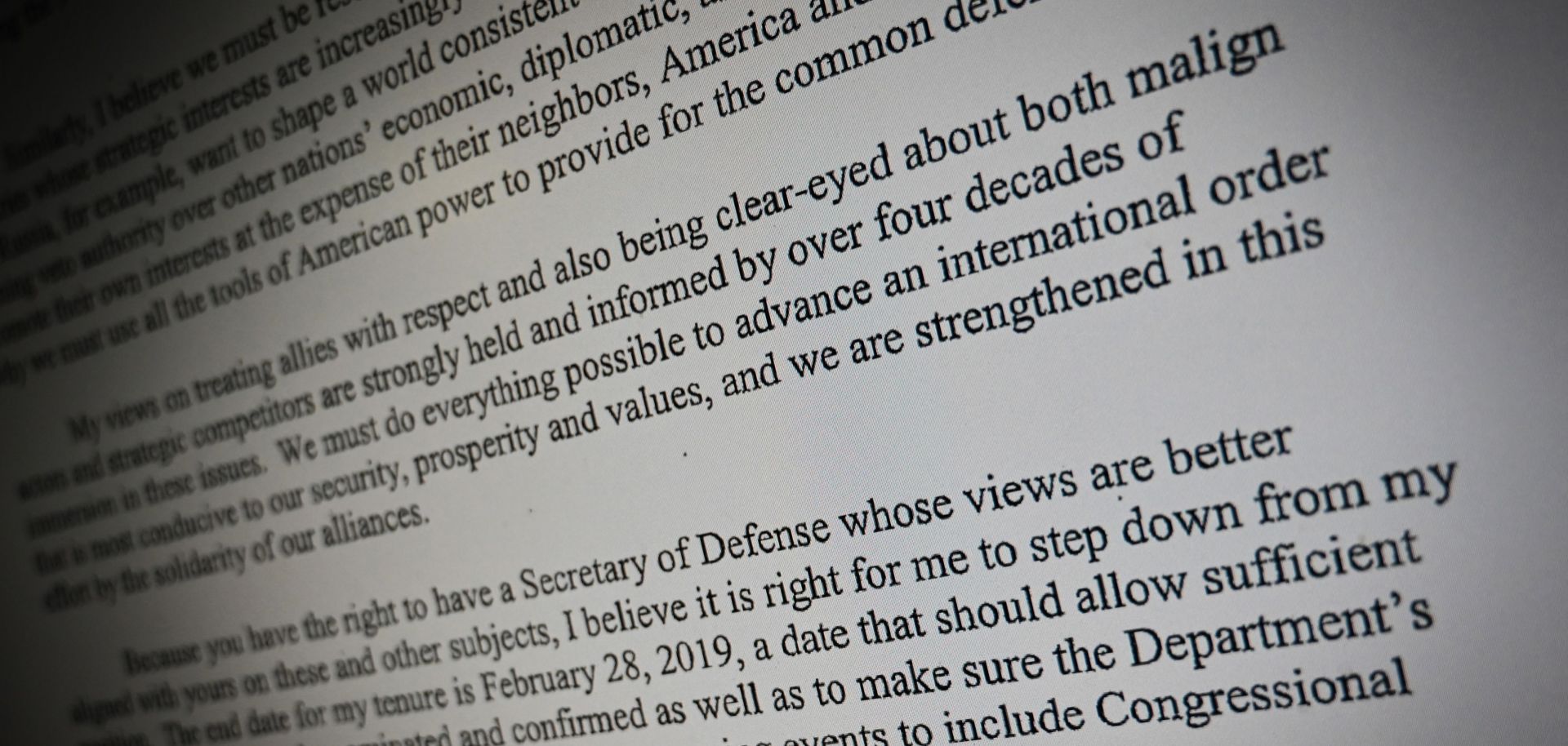

An image of the resignation letter U.S. Defense Secretary James Mattis sent to President Donald Trump on Dec. 20, the day after Trump announced he was pulling U.S. forces out of Syria. In his letter, Mattis suggested his world view, which favors traditional alliances and standing up to "malign actors," was at odds with Trump's.

(AFP/Getty Images)

Subscribe Now

SubscribeAlready have an account?