Oil is the most geopolitically important commodity, and the ongoing structural shift in oil markets has produced clear-cut winners and losers. For many of them, the past 18 months have been a period of slow attrition. Each nation has its own particular level of tolerance, and the following guidance highlights several key break points to monitor.

Russia, Kazakhstan and Azerbaijan stand to lose the most among the countries of the former Soviet Union. As one of the world's largest producers, Russia is the most important. Russia's budget was calibrated to oil prices at $50 per barrel, so Moscow may have to dip into its reserve funds to offset the losses.

Algeria, Iraq, Iran and the oil-producing countries of the Gulf Cooperation Council will feel the most regional impact from low oil prices. For the most part, they can weather low prices with low debt and high financial reserves built up from years of oil revenue.

North America has, of course, been under the same low oil price pressure as the rest of the world. Although production has been somewhat resilient in recent months, it has the potential to fall again as the oil hedges taken out against low oil prices in 2015 expire. The remaining 2016 hedges are mostly at a lower volume or price, a fact that will increase the burden on oil-producing companies.

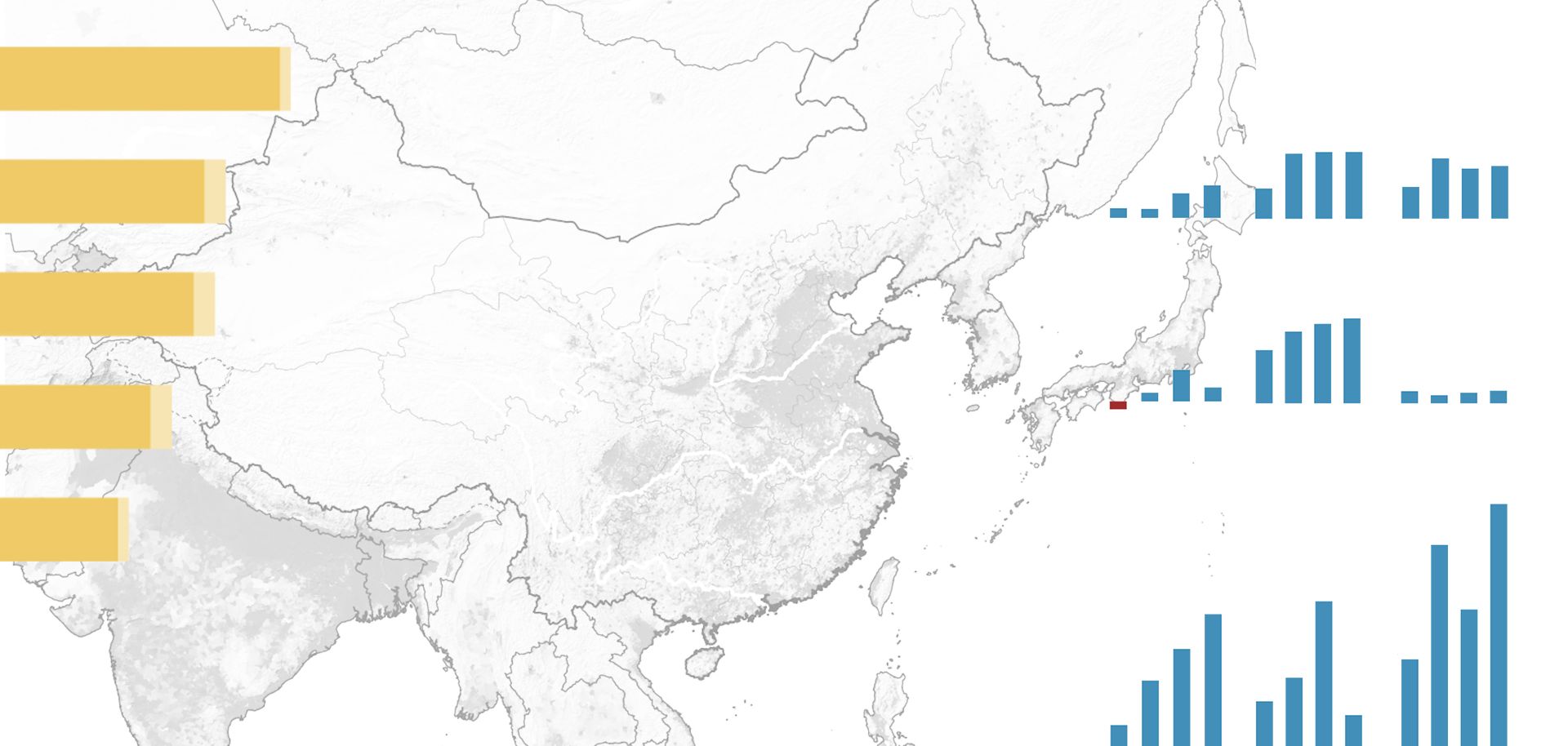

In the Asia-Pacific region, most countries are net consumers of oil, so they stand to benefit from low oil prices. However, as one of the few net producers in the Asia-Pacific, Malaysia will feel the greatest pressure from cheap oil. Indonesia, as a net consumer of oil but a net producer of natural gas, will see mixed results: Natural gas revenue will drop, much to the detriment of state and export revenue, but low oil prices will allow unpopular gasoline and diesel subsidy cuts to be delayed.

Similarly, low oil prices will be largely a boon for Europe because most countries are net oil consumers. In the long run, low oil prices could cause problems across the Continent as a whole, but currently they are improving its economic climate. This could lead Europeans to believe that they are witnessing a "real" recovery when in fact a sizable share of the progress is caused by external factors.