ASSESSMENTS

A Labor Dispute Adds to U.S. West Coast Ports' Troubles

Mar 30, 2015 | 09:15 GMT

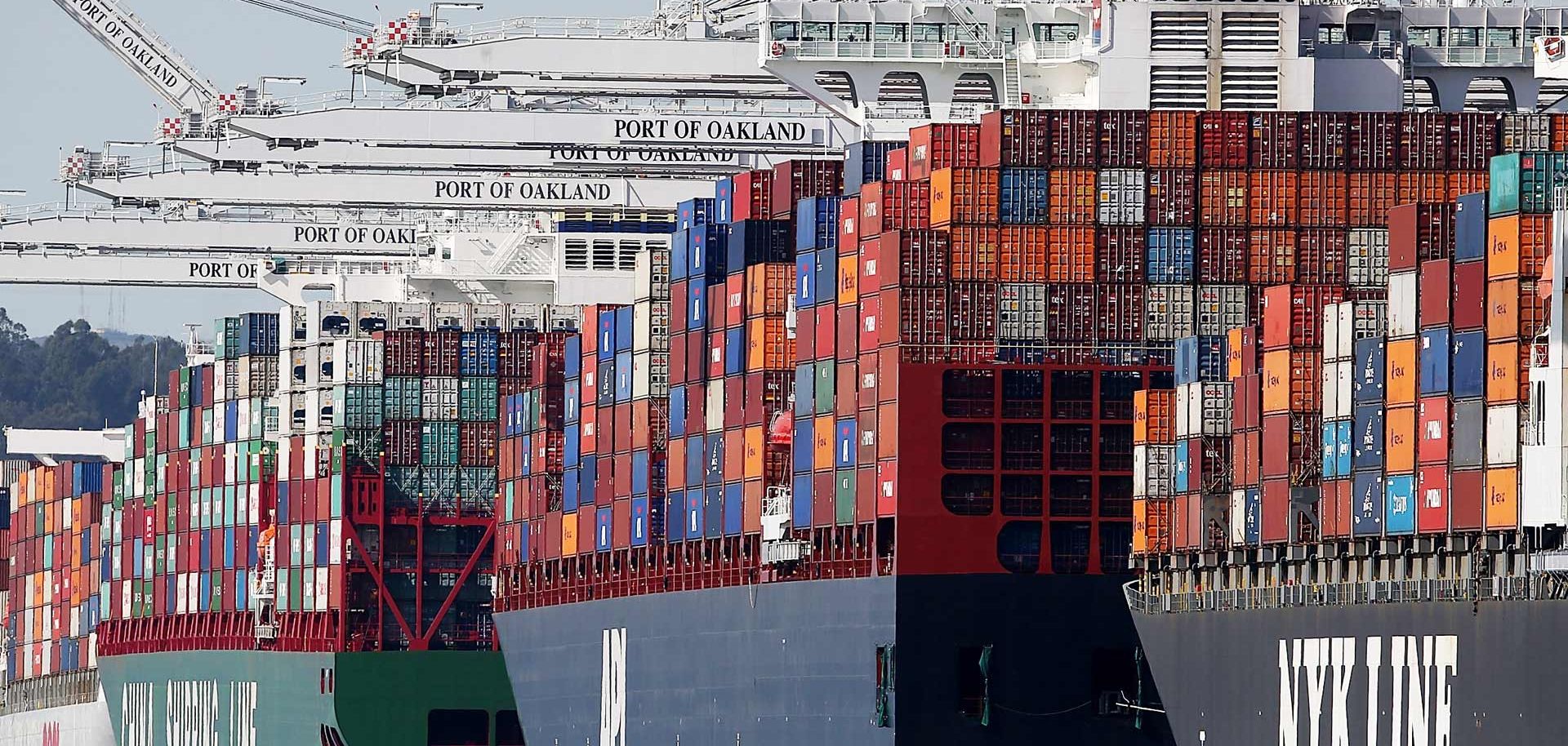

( Justin Sullivan/Getty Images)

Summary

U.S. West Coast ports are emerging from prolonged contract negotiations worse for wear. More than a decade of intermittent labor negotiations, punctuated by sporadic strikes and work slowdowns, has eroded the reputation of these ports. The most recent disputes serve only to emphasize impressions of unreliability and inefficiency. Just as in any other industry, reliability factors into a business's competitiveness. However, much of the traffic that could switch to the Atlantic and Gulf coasts has already done so over the course of the past decade. Numerous factors in the supply chain beyond the ports themselves influence the decision to switch. Some of these are nuances about how supply chains and infrastructure work, but others — specifically, increased low-end manufacturing in select countries that Stratfor has identified as the PC-16 — are geopolitical. The West Coast ports will remain important gateways into the U.S. market but will lose some cargo destined for the central Midwest, where there is still competition between routes.

Subscribe Now

SubscribeAlready have an account?